When planning a trip in 2025, one of the most important things you can do is secure travel insurance.

Flight tickets, hotel bookings, and itineraries may be the first things on your list, but protecting yourself from unexpected costs is just as crucial. So, what does travel insurance cover?

This guide breaks it down in simple terms so you know exactly what you’re paying for and why it matters.

Why Travel Insurance Matters

From flight delays to lost luggage and unexpected medical emergencies abroad, travel can sometimes be unpredictable. Having travel insurance ensures peace of mind, financial protection, and quick assistance when things don’t go according to plan.

With the rise of global travel and changing regulations, more travelers are searching for affordable travel insurance policies that provide comprehensive protection.

For Singaporean, don't worry because there is a lot of travel insurance Singapore covered and this guide will walk you through.

What Does Travel Insurance Cover?

Medical Emergencies Abroad

- Coverage for hospital stays, doctor visits, and medication.

- Emergency medical evacuation if you need to be transported to another hospital or even back home.

- This is often the most valuable part of travel insurance, as overseas medical bills can be extremely high.

Trip Cancellation & Interruption

- There is also trip cancellation insurance, which is you can have reimbursement if you need to cancel your trip due to illness, family emergencies, natural disasters, or other covered reasons.

- Compensation for unused hotel bookings, tours, or flight tickets which you can also cancel your trip.com cancellation insurance in Trip.com website

Lost, Stolen, or Delayed Baggage

- Payment for essential items if your baggage is delayed.

- Compensation for permanently lost luggage and stolen luggage, including personal items such as clothes, electronics, or passports.

Flight Delays & Missed Connections

- Coverage for meals, hotels, and new tickets if your flight is delayed or canceled. Always check trip.com insurance claim if you have ever experience flight delays if you book flight in Trip.com website

- Assistance in arranging alternative connections.

Personal Liability Protection

- Covers accidental damage to property or injury to others during your trip.

COVID-19 & Pandemic-Related Coverage (Check Policy)

- Many travel insurance providers in 2025 now include coverage for COVID-19 related medical expenses, quarantine costs, or trip cancellations. Always confirm with your provider.

What Is Not Covered by Travel Insurance?

While policies vary, most travel insurance exclusions include:

- Pre-existing medical conditions (unless stated in your plan).

- Risky or extreme sports (bungee jumping, skiing, scuba diving) unless you purchase adventure coverage.

- Losses due to reckless or illegal behavior.

How to Buy Travel Insurance on Trip.com

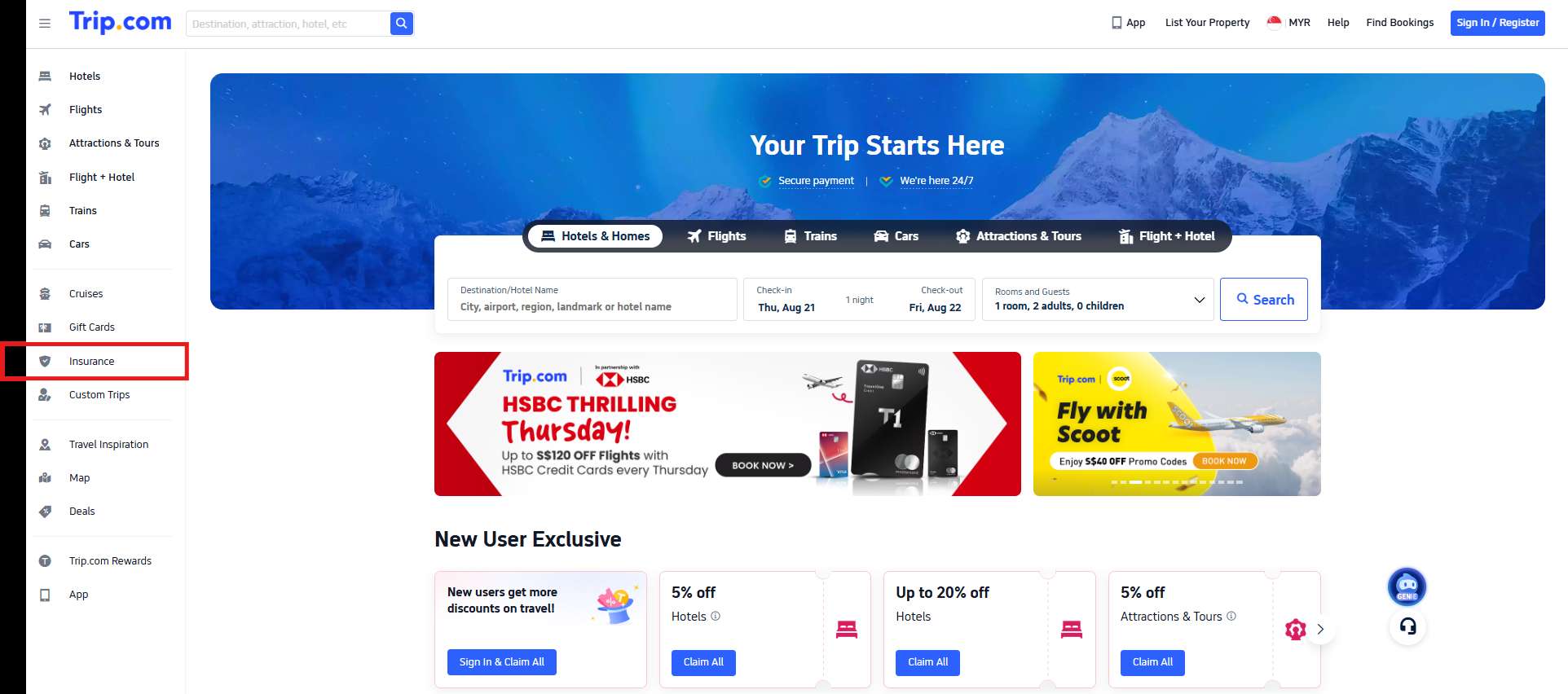

Via the Trip.com Website or Mobile App

Head to the Insurance tab on the Trip.com platform, accessible from the menu bar alongside Flights, Hotels, and Tours. Once there, you’ll find travel insurance highlighted for easy access.

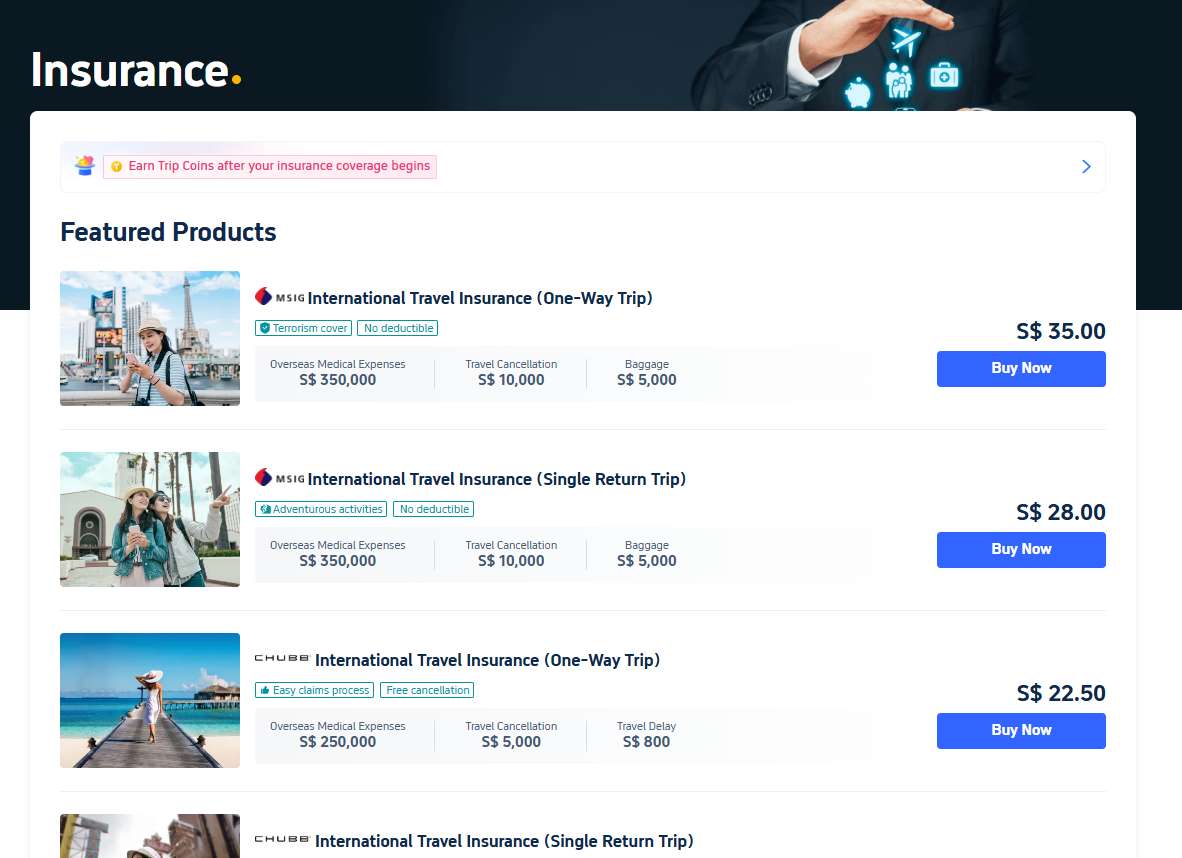

Choose Your Insurance Plans

You can choose which plans you would like to purchase, as low as S$22.50

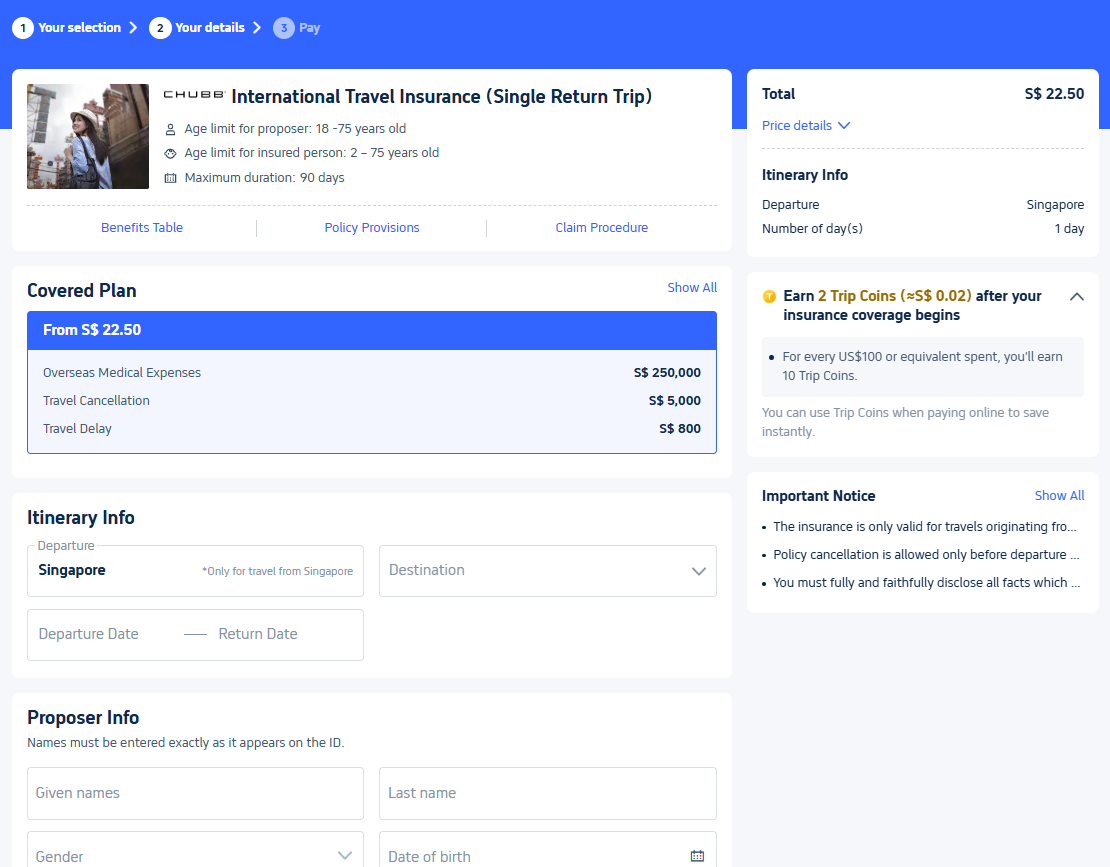

Fill in Your Personal Details

You can fill in all your personal details in the required form and you can already make a purchase, as easy as ABC.

Tips to Choose the Best Travel Insurance in 2025

Compare multiple providers before booking

When buying travel insurance, don’t just settle for the first plan you see. Different providers, whether it’s Trip.com’s Travel Smart by AXA, other online platforms, or your credit card’s travel insurance often offer varying coverage limits, exclusions, and price points. For example, one plan might provide higher medical expense coverage, while another could have stronger protection for trip cancellations or lost baggage.

By comparing providers side by side, you’ll be able to choose the plan that gives you the best value and protection for your specific trip, saving you from overpaying or ending up underinsured.

Travel Insurance Comparison 2025: Trip.com vs Other Providers

Provider / Plan | Medical Coverage | Trip Cancellation | Lost Baggage | COVID-19 Coverage | Convenience & Extras |

|---|---|---|---|---|---|

Trip.com Travel Smart (AXA) | Up to USD 500,000 | Up to USD 3,000 | Up to USD 1,500 | ✅ Included | Easy to add at checkout when booking flights/hotels on Trip.com |

Allianz Travel Insurance | Up to USD 1,000,000 | Strong coverage (varies by plan) | Up to USD 2,000 | ✅ Included | Global brand, wide range of add-ons |

AIG Travel Guard | Up to USD 1,000,000+ | Higher cancellation coverage | Up to USD 1,500 | ✅ Included | 24/7 emergency assistance |

Credit Card Travel Insurance (e.g., Visa / Mastercard Premium Cards) | Usually USD 100,000 – 250,000 | Limited, depends on card | Limited | ❌ Not always included | Free with eligible cards but coverage is often lower |

Budget Online Providers (e.g., FWD, Etiqa) | Around USD 200,000 – 500,000 | Moderate | USD 1,000 – 1,500 | ✅ Most include basic coverage | Affordable, easy to buy online |

Look for COVID-19 coverage if you’re traveling internationally

Even though many countries have eased restrictions, COVID-19 can still disrupt travel plans. Some destinations may require proof of coverage for medical expenses or quarantine costs. Choosing a travel insurance plan that includes COVID-19 benefits such as medical treatment, trip cancellation due to infection, or additional accommodation costs that ensures you’re financially protected and won’t face unexpected expenses abroad.

Check baggage and cancellation limits carefully

Every travel insurance plan has different limits for baggage loss, delay, or damage, as well as trip cancellation or interruption. Before buying, make sure the payout amounts match the value of your belongings and the cost of your trip. For example, if you’re carrying expensive electronics or booking a luxury holiday, you’ll want higher coverage. You can also check rules and regulations of baggage every airlines before boarding.

Buy insurance early to maximize trip cancellation benefits

The sooner you purchase your travel insurance after booking your trip, the more protection you get. Many policies only cover cancellations for events that happen after the insurance is purchased. Buying early ensures you’re protected if unexpected situations like illness, natural disasters, or sudden work obligations to force you to cancel before departure. This way, you maximize your trip cancellation benefits and safeguard your travel investment.

Conclusion: Is Travel Insurance Worth It?

Yes! Travel insurance is worth it in 2025. Whether it’s a sudden illness, lost passport, or canceled flight, having coverage ensures you’re financially protected and less stressed when things go wrong. Before your next trip, compare travel insurance policies, do a research on where to buy travel insurance and select the best fit for your journey.

Proper preparation and careful planning before your trip can make all the difference in ensuring a smooth and stress-free journey. By organizing your travel documents, booking tickets in advance, and researching your destination, you’ll have more time and freedom to fully enjoy the experience. With everything in order, you can focus on exploring countless attractions, joining guided tours, and immersing yourself in the culture without unnecessary worries.

FAQ ; What Does Travel Insurance Cover?

Does travel insurance cover medical expenses abroad?

Yes, many policies include overseas medical coverage, which can help pay for hospital stays, doctor visits, and emergency evacuation.Are adventure sports covered by travel insurance?

Not always. Activities like skiing, scuba diving, or hiking may require optional add-ons or special coverage.Does travel insurance cover pre-existing conditions?

Some plans do, but usually only if you purchase the policy soon after booking your trip. Check terms carefully.