Planning your trip to Singapore and wondering if you'll need cash for the hawker centres or if your credit card will do?

This guide breaks down everything you need to know about paying in Singapore, from cash and credit cards to mobile wallets and transport cards.

Singapore is one of the easiest places in Asia for cashless payments. Whether you prefer tapping your phone, using your credit card, or scanning a QR code, most shops, cafés, and attractions accept digital payments seamlessly.

Just make sure your card is enabled for international use, and you can settle almost everything with a quick tap.

Mobile Payments and E-wallets for Quick and Contactless Transactions 📱

Using your phone to pay is extremely common in Singapore. Apple Pay and Google Pay work smoothly across the city, especially in major malls, supermarkets, restaurants, and public transport.

Most travellers only need to add their credit or debit card to their phone wallet. Once it is linked, you can tap to pay almost everywhere with no extra setup. This is one of the reasons tourists love the convenience of Singapore. Everything feels fast, organised, and made for travellers on the go.

Two ways mobile payments are commonly used in Singapore💟

1. Tap to Pay with Your Phone

Just hold your phone near the payment terminal and wait for the confirmation beep. This works at MRT gantries, buses, coffee shops, retail stores, and even vending machines.

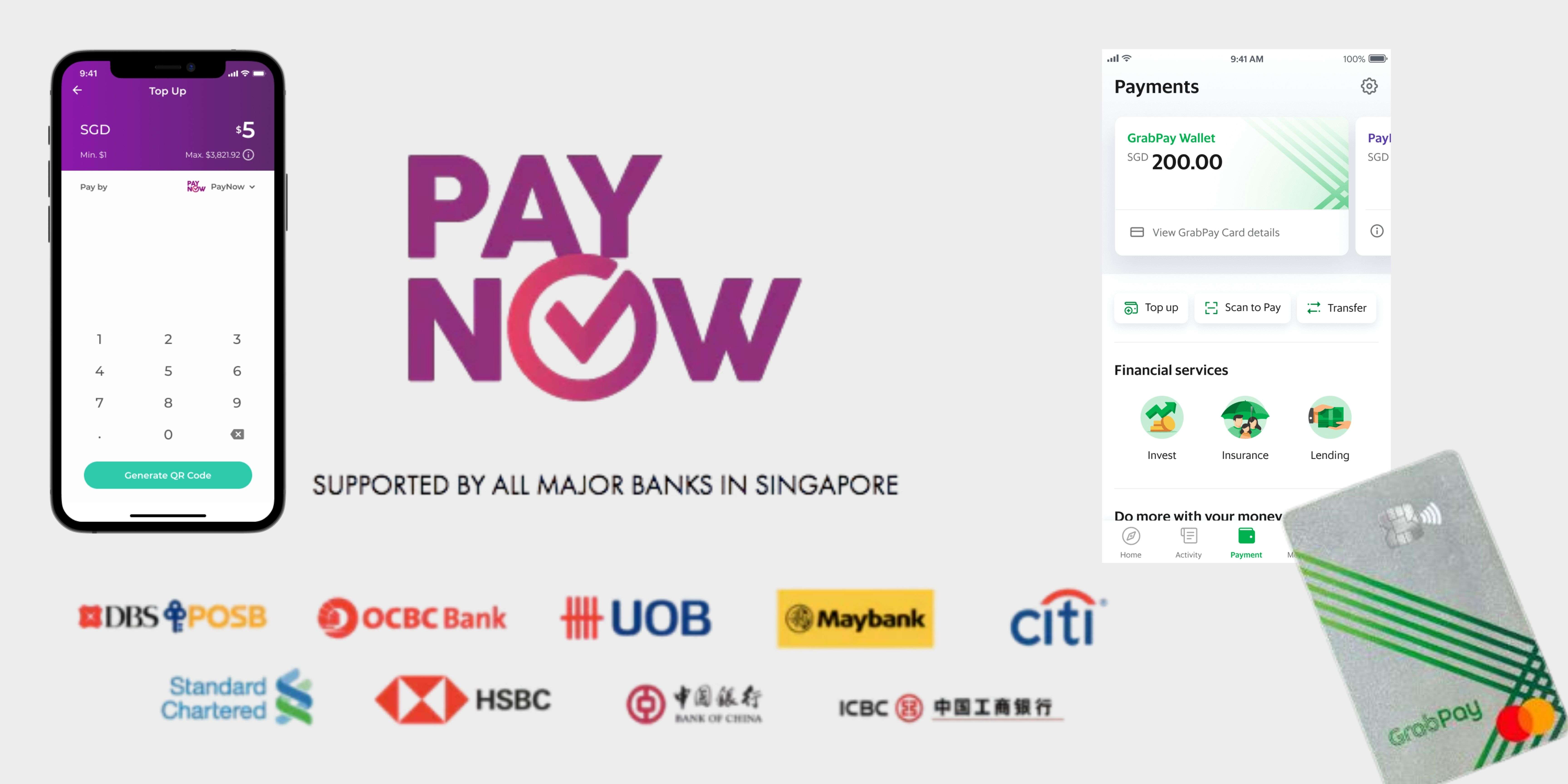

2. Use QR Codes at Selected Stores

Some merchants, especially in hawker centres or neighbourhood stalls, display a PayNow or SGQR code. You can scan these codes using certain apps or mobile banking apps. Although not every traveller uses QR in Singapore, it is becoming more common and helpful to have as a backup.

Friendly Apps for Extra Convenience 👛

Some travellers enjoy using apps like GrabPay because they are already familiar with them in Malaysia or the region. In Singapore, GrabPay works for rides, food delivery, and selected merchants, making it useful if you already have the app set up.

You can link your credit or debit card inside the app, top up your wallet, and start using it immediately.

Tips for Using E Wallets and Mobile Apps

- Always ensure your app is updated to the latest version.

- Keep your phone charged when relying on e-wallets.

- Set a small auto-top-up limit to avoid running out of balance.

- Link at least one backup credit/debit card for safety.

- Enable biometric login for security and faster access.

Special Offer: Exclusive Hotels Deal for New Users

From now until stock last, you can enjoy up to 8% off when you register as a member by desktop, mobile and app, click here to view more!

EZ-Link and NETS FlashPay Cards for Transport and Daily Use 🚆

While Singapore’s public transport accepts contactless cards and mobile payments, many travellers still prefer the classic EZ-Link or NETS FlashPay card.

These cards are simple, reliable, and work even when your phone battery is low. You can use them for:

- MRT and LRT rides

- Public buses

- Selected supermarkets

- Convenience store purchases

- Payment at tourist attractions

Why travellers like these cards:

- Easy top up at MRT stations and convenience stores

- No need to rely on mobile signal

- Convenient for short trips or budget planning

Credit and Debit Cards for Shopping, Dining, and Hotels 💳

Visa and Mastercard are widely accepted throughout Singapore. Most restaurants, cafés, hotels, and retail stores prefer card payments because they are quick and efficient. Even airport transfers, ride hailing apps, and theme parks allow you to pay by card without hesitation.

Cards are especially helpful for:

- Hotel bookings

- Restaurant dining

- High value fashion and electronics

- Airport transfers

- Online purchases and attraction tickets

Before travelling, remember to:

- Enable overseas transactions in the bank websites or apps

- Check if your bank charges foreign transaction fees

- Use contactless cards for smoother payments

Most travellers rely on cards as their main payment method because they are secure and accepted almost everywhere.

Cash for Hawker Centres and Local Neighbourhood Shops 💸

Although Singapore is highly digital, cash still plays an important role in certain places. Hawker centres, small food stalls, and older establishments may prefer cash, especially if the amount is very small. Carrying around SGD 20 to SGD 50 in small notes usually solves everything.

ATMs are widely available, so withdrawing Singapore dollars is easy as long as your card supports international use.

🔥Save More with an Extra 5% Off – New Users Only

Use our promo code to enjoy an extra 5% off (up to S$4) on your attraction tickets, eSIMs, and tours!

⏳ Redeem within 3 days of claiming

Common Payment Situations in Singapore 🐾

| Payment Method | Best for Transport | Best for Hawker Centres | Widely Accepted? | Fees for Tourists |

|---|---|---|---|---|

Cash (SGD Notes & Coins) | ❌ Not convenient for MRT/bus | ✅ Most convenient | ✅ Universally accepted | None |

Credit Card | ✅ Works for MRT/bus via contactless in some cases | ⚠️ Limited; some stalls don’t accept cards | ✅ Widely accepted in shops, restaurants, attractions | Possible foreign transaction fees for non-Singapore cards |

EZ-Link / NETS FlashPay Card | ✅ Best for MRT, LRT, buses | ⚠️ Limited; some hawker stalls may not accept | ✅ Widely for transport & some retail | Minimal top-up fees |

Mobile Wallets (Apple Pay, Google Pay, PayNow QR) | ✅ Can be used for transport if linked to EZ-Link/contactless | ⚠️ Some stalls accept QR; cash safer | ✅ Increasingly accepted in shops, attractions, food delivery | Usually no fees, but may depend on card linked to wallet |

Extra Points for Payment Methods in Singapore

Paying in Restaurants, Cafés, and Shops 🛍️

Most places accept contactless cards and mobile payments. If you are unsure, the staff will guide you. Singapore service staff are usually friendly and used to assisting tourists.

Paying for Public Transport 🚇

Simply tap in and tap out using your contactless card, mobile wallet, or EZ-Link card. It is very seamless and tourist friendly.

Paying in Hawker Centres and Neighbourhood Stalls 🍜

Some stalls accept QR payments, but cash remains the safest option. Keeping small change makes things easier.

Paying for Attractions and Tickets 🎟️

Major attractions like Universal Studios Singapore, Gardens by the Bay, and the Singapore Flyer accept mobile payments, cards, and online bookings. Many travellers prefer buying tickets online for faster entry.

Paying for Online Services and Food Delivery 🛒

Apps like Grab, Foodpanda, and Shopee accept cards and e wallets. Saving your payment method in the app speeds up checkout.

Hotel Deals in Singapore

Tourist Passes vs. Standard Cards

When traveling in Singapore, choosing the right transport card can make your journey smoother and more cost-effective.

Singapore Tourist Pass

Eligibility

Available exclusively for short-term tourists visiting Singapore.

Purpose & Usage

Unlimited rides on MRT, LRT, and public buses for the validity period, making it ideal for sightseeing and multiple daily trips.

Cost & Validity Options

Options include 1-day, 2-day, or 3-day passes. Prices range from SGD 10–20, excluding a refundable SGD 10 deposit.

Pros & Cons

- Pros: Unlimited rides, no need to top up daily, convenient for tourists.

- Cons: Only valid for tourists; deposit required.

Standard EZ-Link Card

Eligibility

Available for locals, residents, and tourists alike.

Purpose & Usage

Pay-per-ride system on MRT, LRT, and public buses. Can also be used for small retail purchases at select stores.

Cost & Top-Up

Initial card cost: SGD 12 (SGD 5 card + SGD 7 minimum top-up). Reloadable; balance remains valid until depleted.

Pros & Cons

- Pros: Flexible, usable beyond transport, no time limit on validity.

- Cons: Pay-per-ride can be more expensive for tourists making multiple trips daily.

Mobile Payments

Singapore supports a variety of mobile payment methods, making transactions easy and cashless.

Apple Pay / Google Pay

- Tap and pay with your linked credit/debit cards at most shops, cafés, and attractions.

- Widely accepted across retail stores and public transport terminals.

Local Apps like GrabPay

- Integrated into popular local apps like Grab for rides, food delivery, and online shopping.

- Can be linked to Singapore bank accounts or cards for seamless payments.

Travel in Singapore with Ease 🤩

Paying in Singapore is simple and worry free. Your phone and contactless card will cover almost every situation. Keep an EZ-Link card if you prefer a traditional and reliable option, and always have a little cash for hawker meals and neighbourhood finds. With these essentials, you can explore Singapore comfortably and enjoy every moment without thinking too much about how to pay.

FAQs about Payment Methods in Singapore

Do I need an EZ-Link card if I already have a contactless card?

Not necessarily. You can tap in and out of public transport using your contactless credit or debit card. However, many travellers still like the EZ-Link card because it is simple, reliable, and doesn’t depend on phone battery or international network.Does Singapore accept Alipay or WeChat Pay?

Some stores do, especially in tourist areas or Chinese-owned businesses. However, Alipay and WeChat Pay are not as commonly used for everyday transactions compared to cards and Apple Pay.Can I use my smartwatch to pay?

Yes. Most terminals accept Apple Watch, Garmin Pay, Fitbit Pay, and Samsung Pay. As long as your device is linked to a supported card, you can tap as you normally would.Can I use my card to pay for buses and MRT with no extra fee?

Most banks charge the same rate as any overseas transaction. There is no additional fee from Singapore’s transport operators, so the charge is simply what your card issuer applies.

NO.1

NO.1