If you’re planning a shopping trip to Taiwan, understanding the Taiwan tourist tax refund system can help you save money.

This guide explains the Taiwan tax refund rate, eligibility rules, how to claim your refund, and answers the common question: Does Taiwan have tax refund for tourists?

Does Taiwan Have Tax Refund for Tourists?

Yes. Taiwan offers a Value-Added Tax (VAT) refund to foreign visitors who meet conditions on certain purchases.

Taiwan’s tourist tax refund program is designed to encourage spending by international travelers while making shopping more attractive.

This applies only to goods purchased from stores displaying the Tax Refund Shopping (TRS) logo.

Taiwan Tax Refund Rate

Taiwan’s VAT is 5%, which forms the base of the refund.

However, a service fee is deducted during the refund process, so tourists receive slightly less than 5%.

While the exact net amount varies depending on the refund operator, travelers generally receive around 4%+ after fees.

Top Things To do In Taipei

How Much Is Tax Refund in Taiwan?

The final refund amount depends on:

- Total purchase amount

- Taiwan tax refund rate (5% VAT)

- Service fees deducted at the counter

For example, if you spend NT$10,000 on eligible goods:

For precise numbers, many travelers use a Taiwan tourist tax refund calculator

Best Hotels in Taipei

Who Is Eligible for Tax Refund in Taiwan?

You qualify for the tax refund in Taiwan for tourist if you:

| Eligibility Requirement | Description |

|---|---|

Stay Duration | You must be a foreign traveler staying in Taiwan for less than 183 days. |

Minimum Purchase Amount | You must purchase goods worth NT$2,000 or more in a single day from the same TRS-listed store. |

Goods Export Requirement | You must take the goods out of Taiwan within 90 days from the purchase date. |

Passport Requirement | You must present your passport when shopping or receiving the tax refund form. |

Qualify Expiry | You must take the purchased goods out of Taiwan within a set time (typically within 90 days) to qualify. |

Where Can You Get Tax Refund?

There are a few ways you can claim your VAT refund:

On-site (Small-Amount) Refund in Stores

- Certain TRS-labeled stores offer an on-the-spot refund for purchases if you meet certain criteria.

- As of a policy update, purchases between NT$ 2,000 and NT$ 48,000 (on the same day, same store) are eligible for on-site small-amount refunds.

- For smaller refunds (e.g., total VAT refund under NT$ 1,000), it might be more convenient to do it at the store itself if they support this.

Refund at Airport or Seaport (Departure)

- Before checking in your luggage, you need to go to a VAT Refund Service Counter (or use an e-VAT refund machine) at the airport or seaport.

- You’ll need to present your passport, your invoice(s), and your “Application Form for VAT Refund.”

- Customs may inspect your purchased goods, so you should have them with you at the counter when required.

- After everything is approved, you’ll receive a “Tax Refund Assessment Certificate” which you can then take to a bank counter or cash counter in the airport to get your money.

Available at:

- Taoyuan Airport (TPE)

- Taipei Songshan Airport (TSA)

- Kaohsiung Airport (KHH)

- Taichung Airport (RMQ)

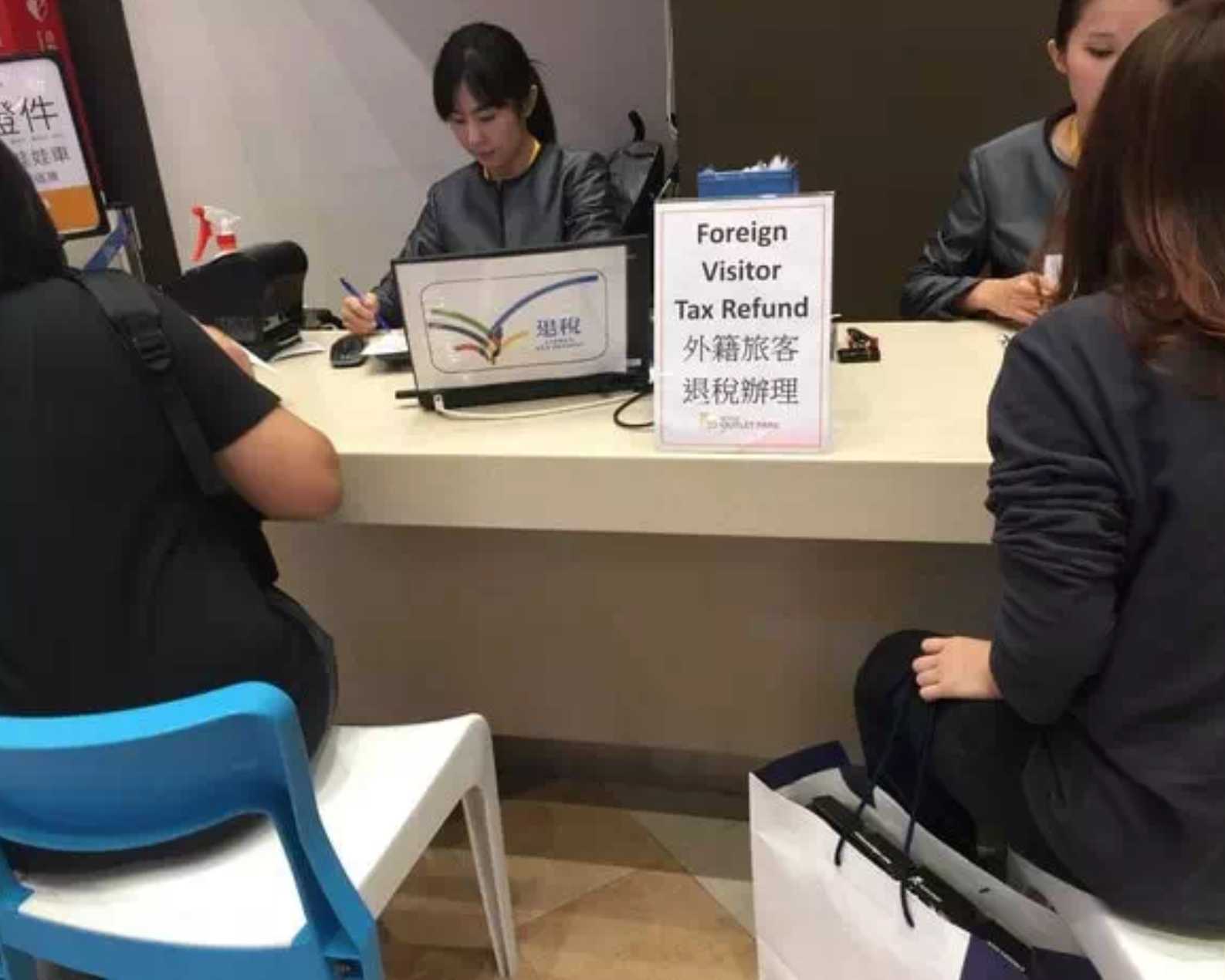

Refund via Designated Counters Outside Airport

- There are TRS-labeled service counters in certain areas outside of airports/seaports.

- For these, there may be a security deposit required (e.g., a hold on your credit card) in case the goods are not taken out of Taiwan or don’t pass customs checks.

- If during inspection the goods are disqualified, you may have to forfeit that deposit.

How to Get Tax Refund in Taiwan (Step-by-Step)

Step 1: Shop at TRS Stores

- Look for the Tax Refund Shopping sign.

- Tell the cashier you want to apply for tax refund; they will prepare the form.

Step 2: Keep All Receipts & Pack Goods Properly

- Items must remain unused until inspection.

Step 3: At the Airport

- Go to the Tax Refund counter or e-machine

- Present passport + receipts

- Customs may check your purchases

- Receive the refund certificate

Head to the cash counter to collect your refund or process it through card/bank (depending on airport option)

Required Documents

To claim your Taiwan tourist tax refund, you must prepare:

| Document | Purpose / Description |

|---|---|

Passport | Required to verify your identity and tourist status. |

Refund form or electronic invoice | Proof of eligible purchases from TRS-listed stores. |

Purchased goods for inspection (if required) | Customs may check items to confirm they are unused and will be taken out of Taiwan. |

Boarding pass or travel itinerary | Confirms your outbound travel details for processing the refund. |

Eligible vs Not Eligible for Taiwan Tax Refund

| Eligible Items | Not Eligible Items |

|---|---|

Fashion & apparel | Services (hotels, tours, transportation) |

Electronics | Food & consumables already opened |

Cosmetics & skincare | Items not taken out of Taiwan |

Souvenirs | — |

Lifestyle goods | — |

Why Taiwan’s Tax Refund Is Attractive'

- The 5% VAT rate is relatively low, but the refund still gives meaningful savings, especially on higher-ticket items.

- The relaxed rule (since 2019) allows for on-site tax refunds up to a higher purchase amount (NT$ 48,000), making it more flexible for travelers.

- The presence of e-VAT self-service machines speeds up the process at departure points.

- For heavy shoppers (electronics, luxury goods), this can significantly offset the cost — especially when combined with favorable Taiwan retail prices.

Common Pitfalls & Mistakes to Avoid

Shopping at Non-TRS Stores

If a store doesn’t have the TRS label, your purchases from there can’t be refunded.

Mixing Invoices

Ensure that the required minimum spend (e.g., NT$2,000) is in a single store on the same day. Splitting across different stores usually doesn’t count.

Losing Invoices or Forms

Without the original uniform invoice and the VAT refund claim form, the counter may deny your refund.

Missing Customs Inspection

If you skip the inspection when required, your refund could be denied or reversed.

Not Watching Time Limits

Make sure to complete your refund claim within the valid timeframe (purchase date vs departure date).

Not Budgeting Enough Time at the Airport

The refund process can take time, so don’t leave it to the last minute before your flight.

Important Rules & Tips to Know

Time Limit

You must apply for your refund before departure, and the purchase must have been made within 30 to 90 days (depending on the regulations) of your departure.

For example, Taoyuan’s site says purchases must be refunded within 90 days.

Documentation

Keep all your uniform invoices or e-invoices (receipts), and make sure the shop writes your passport number on them when you make the purchase.

Goods Inspection

Be prepared for customs to inspect the goods.

If they determine the goods are “used, unpacked, or opened,” they may reject the refund.

Refund Method

Refunds at the airport or port are often given at designated bank or cash counters.

Plan Ahead

Because the refund process takes time, arrive at the airport early, Taoyuan’s tourism guide recommends arriving 3 hours before departure to complete the tax refund process.

Store Participation

Not all stores offer tax refund, only those with the “Tax Refund Shopping (TRS)” label.

Refund for Cultural Sites

As of recently, places like the National Palace Museum also offer the tax refund service for eligible purchases over NT$2,000.

Fly to Taipei

Tips to Maximise Your Taiwan Tax Refund

Have Fun Shopping in Taiwan!

Taiwan’s tourist tax refund system is quite traveler-friendly and offers a 5% VAT refund for eligible foreign visitors.

By shopping smartly at TRS-labeled stores, keeping your receipts and passport handy, and applying for your refund before leaving Taiwan, you can recoup a portion of your expenses.

The process is relatively straightforward if you're prepared, and it’s a great way to make the most of your Taiwan shopping experience.

FAQ: Taiwan Tax Refund

Does Taiwan have tax refund?

Yes, Taiwan offers VAT refunds for eligible foreign tourists.Is the Taiwan tourist tax refund available for online purchases?

No, only for in-store purchases at TRS-registered shops.Can I get tax refund on food in Taiwan?

Only if it is packaged, unopened, and purchased at a TRS store.How to get tax refund in Taiwan efficiently?

Use e-refund machines at airports; they’re faster than manual counters.How much is the tax refund in Taiwan?

Up to 5% VAT minus service fees; typically about 4% net.

6319 booked

6319 booked