Ever stared at your bank statement and thought, “This coffee run, this grocery shop, could it all add up to a free flight?” It can, with the right credit card. If you love travelling, the UOB PRVI Miles Card is one of the best tools in your wallet. Let’s break down exactly how it works, including earning miles to unlocking a free airport lounge.

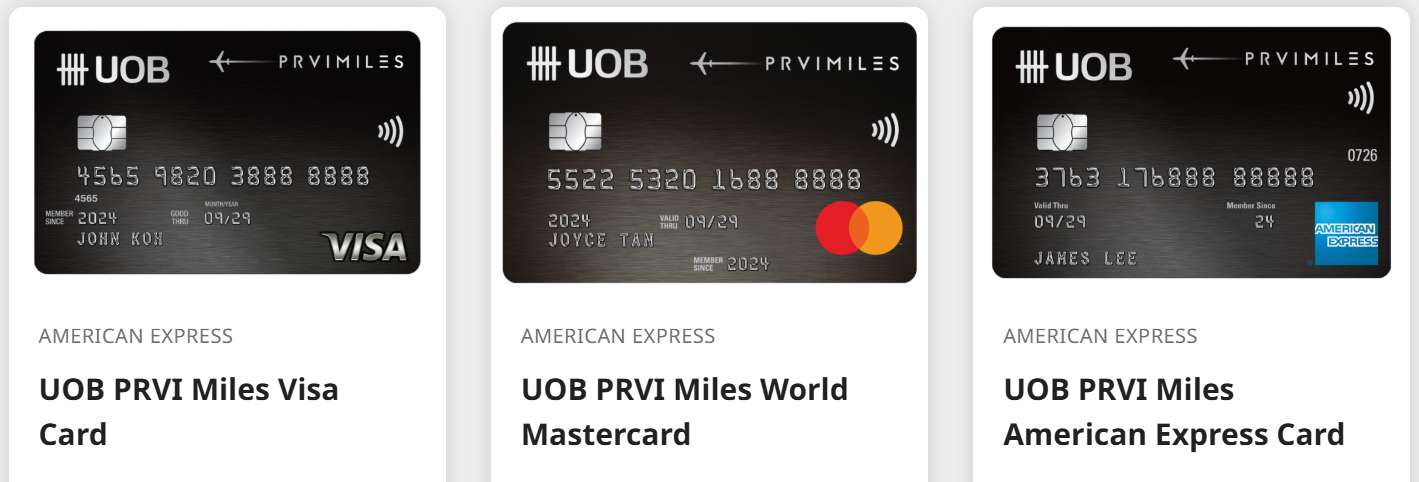

What Is the UOB PRVI Miles Card?

The UOB PRVI Miles Card is a travel-focused credit card designed for people who want to earn airline miles on both local and overseas spending. Instead of locking you into a single airline programme, it earns UNI$, which can later be converted into miles with major frequent flyer programmes.

What makes it appealing is its balance: solid earn rates, strong overseas spending bonuses (especially within Southeast Asia), and travel perks.

What Are the Key Benefits of UOB PRVI Miles Card?

Benefit Category | Details |

Miles Earning | - No miles cap - Up to 3 miles/S$1 on overseas spend - 1.4 miles/S$1 on local spend - Up to 8 miles/S$1 on hotels/airlines |

Travel Perks | - 4 complimentary Priority Pass airport lounge visits per calendar year - Complimentary travel insurance |

Trip.com Exclusive Offers | - 8% off hotels (taxes and fees included) - 3% off flights (before taxes and fees) - Validity: Till 31 Dec 2026 |

🔥Trip.com x Visa Card Promotion

📆The promotion period for this offer is from 1/May 2025 to 31/Dec 2026.

How to Earn Miles with the UOB PRVI Miles Card?

Here’s exactly how much you’ll get for every type of spend, plus how to boost your miles even more.

Miles Rates for Overseas Spend

Up to 3 miles per S$1.

If you’re travelling to Malaysia, Indonesia, Thailand, or Vietnam, you’ll earn a full 3 miles for every S$1 you spend. For other overseas destinations (or international online shopping, like buying clothes from a UK website), you’ll still get 2.4 miles per S$1. That’s way more than most entry-level cards, which often cap at 1.5 miles.

Miles Rates for Local Spend

1.4 miles per S$1.

This is where the card shines for everyday use. Whether you’re tapping your card for MRT rides, paying utility bills, or grabbing lunch at the hawker centre, every S$1 adds 1.4 miles to your balance. Over a month, that coffee run (S$5 x 20 days = S$100) would earn you 140 miles, enough to chip away at a short-haul flight.

Hotel & Airline Bookings

Up to 8 miles per S$1.

This is the big one for travellers. Book major airlines or hotels, charge it to your card, and you’ll earn 8 miles per S$1. A S$1,000 hotel stay? That’s 8,000 miles, almost enough for a free flight from Singapore to Kuala Lumpur or Jakarta.

Trip.com exclusive perks: Book hotels and flights via Trip.com’s dedicated UOB PRVI Miles portal, and you’ll unlock 8% off hotels and 3% off flights!

Annual Spend Bonus for Big Spenders

If you use your card for most expenses (or have a big travel year), you could unlock an extra 20,000 loyalty miles. UOB PRVI Miles American Express® Cardmembers who spend at least S$50,000 in a membership year get UNI$10,000 (equal to 20,000 miles). That’s enough for a free flight from Singapore to Sydney or Tokyo.

Boost Miles with a UOB KrisFlyer Account

Want to supercharge your miles? Link your UOB PRVI Miles Card to a UOB KrisFlyer Account. Here’s how it works:

1. Open a new KrisFlyer UOB Deposit Account.

2. Do one of two things:

- Maintain a minimum S$1,000 monthly average balance, and you’ll earn up to 5 bonus KrisFlyer miles per S$1 spent on your card.

- Credit your salary (min. S$1,600/month) to the account, and you’ll get up to 6 bonus KrisFlyer miles per S$1.

3. Combine that with the card’s regular 8 miles per S$1 on hotels/airlines, and you could earn up to 14 miles per S$1.

And yes, the bonus miles are automatically transferred to your KrisFlyer account every month, no conversion fees, no paperwork.

What Are the Unmissable Travel Perks of the UOB PRVI Miles Card?

Miles are great, but the UOB PRVI Miles Card’s real magic is in its travel perks.

Free Airport Lounge Access (No More Waiting in Crowds)

The UOB PRVI Miles Card gives you 4 complimentary Priority Pass lounge visits per year (for principal cardholders). That means you can relax in over 1,700 lounges worldwide before your flight.

Here’s how to use it:

- Download the Priority Pass app to register and get your digital membership card (no physical card needed for most lounges).

- Show your digital card and ID (like a passport) at the lounge entrance.

Important notes:

- Guests aren’t free—you’ll pay US$35 per guest per visit.

- If you use more than 4 visits in a year, excess visits cost US$35 each (charged to your card).

- For Mastercard/Visa cardholders: You can also use your physical UOB PRVI Miles Card to enter lounges, just activate it via your Priority Pass account (it takes up to 12 hours to work).

Complimentary Travel Insurance

Nothing ruins a trip like a medical emergency or lost luggage. The UOB PRVI Miles Card includes free travel insurance.

Coverage details:

- S$500,000 public conveyance personal accident cover (for flights, trains, buses, etc.).

- Up to S$50,000 for emergency medical evacuation and repatriation.

To activate it:

- Opt-in at least 5 working days before your trip (you can do this online via UOB’s website).

- Charge the full cost of your public conveyance (like your flight ticket) to your UOB PRVI Miles Card.

Bonus: Since 1 January 2024, the insurance extends to your spouse and dependent children for selected UOB Cards, so the whole family is covered.

Extras for American Express® Cardholders

If you pick the UOB PRVI Miles American Express® Card, you get 2 free airport transfers per quarter: Spend at least S$1,000 on overseas purchases in a quarter, and you can book two complimentary airport transfers.

Note:

- Call 6651 22253 (9am–6pm) to book, and remember to do it at least 2 days before your pickup. The cost will be charged to your card first, then credited back as cashback at the end of the quarter.

- Surcharges apply: S$10 for pickups over 35km to Changi Airport (since 1 Sept 2022) and S$10–$20 for larger vehicles (like 6-seater MPVs or 9-seater vans) from 1 Feb 2025.

🔥Exclusive Hotels Deal: Up to 10% OFF for New Users

Discover the world with trip.com! Book the perfect hotel anywhere in the world and get an unbeatable 10% discount if you're a first-time user! Download our app now and start planning your next trip with ease.

Who Can Apply the UOB PRVI Miles Card?

Applicant Type | Minimum Age | Minimum Annual Income | Alternative (if no income) |

Singapore Citizens/PRs (55 & below) | 21+ | S$30,000 | S$10,000 fixed deposit collateral |

Singapore Citizens/PRs (56+) | 21+ | S$15,000 | S$10,000 fixed deposit collateral |

Foreigners | 21+ | S$40,000 | S$10,000 fixed deposit collateral |

You’ll also need to provide basic documents, like your NRIC/Passport and proof of income.

UOB PRVI Miles Fees (First Year Free!)

No one likes annual fees, but the UOB PRVI Miles Card keeps costs low, especially for first-time users.

Card Type | Annual Fee | Key Notes |

Principal Card | S$261.60 | First year’s fee fully waived |

Supplementary Card (1st) | S$0 (complimentary) | No charge for the first supplementary card |

Supplementary Card (2nd+) | S$130.80 | Applicable from 1 January 2023 |

Pro tip: If you’re worried about future annual fees, check UOB’s promotions. They often offer fee waivers for cardholders who spend a certain amount each year.

Is the UOB PRVI Miles Card Right for You?

This card isn’t for everyone. It’s perfect if:

- You travel at least once or twice a year (even short trips!).

- You spend regularly on overseas shopping, dining, or local expenses (like commuting or bills).

- You hate complicated rules, no minimum spend, no miles cap, just simple earning.

- You prefer flexible airline mile transfers instead of being locked into a single frequent flyer programme.

It’s less ideal if:

- You rarely travel and prefer cashback over miles.

- You don’t want to pay an annual fee after the first year (though waivers are common).

How to Apply for the UOB PRVI Miles Card?

Existing UOB principal cardholders: Send an SMS to 77672 with:

- For Visa: <YesmilesV> <Last 4 digits of your existing UOB card> <Your NRIC>

- For Mastercard: <YesmilesM> <Last 4 digits of your existing UOB card> <Your NRIC>

- For American Express: <YesmilesA> <Last 4 digits of your existing UOB card> <Your NRIC>

- New applicants: Apply via UOB’s website or use Myinfo for faster processing.

Buy Cheap eSIM Now

Tips to Maximise the UOB PRVI Miles Card

The UOB PRVI Miles Card often comes with a welcome bonus, typically requiring you to meet a minimum spending amount within a set period.

A smart approach is to apply when you already have upcoming expenses such as travel bookings, insurance payments or larger purchases. This way, you hit the spending requirement naturally without overspending just for the sake of miles.

If you want to get the most value, use this card for overseas spending whenever possible, especially within Southeast Asia.

Your Next Trip Starts with the Right Credit Card!

If you want a reliable travel credit card that rewards both everyday spending and overseas adventures, the UOB PRVI Miles Card is a solid choice. Every coffee, every shopping trip, every hotel booking adds up to miles that can take you anywhere, from a weekend in Penang to a beach getaway in Bali.

So what are you waiting for? Apply for the UOB PRVI Miles Card today and start counting down to your next adventure.

FAQs About the UOB PRVI Miles Card

Can my spouse (a supplementary cardholder) use the airport lounge?

Supplementary cardholders don’t get free lounge visits. If they want to enter, you’ll pay US$35 per visit. Alternatively, they can sign up for their own Priority Pass membership (US$99 per year) and pay US$35 per visit.Can I still use my Priority Pass lounge access if I lost my UOB PRVI Miles Card?

First, report the lost card to UOB (call 1800 222 2121 locally or +65 6222 2121 overseas). Once you get a new card, update your Priority Pass account with the new card number, then you can use the lounge again.How do I convert my UNI$ to frequent flyer miles?

Enroll in UOB’s Frequent Flyer Conversion Programme. You can choose to auto-convert UNI$ to KrisFlyer Miles or Asia Miles, or convert them on demand. You can also use UNI$ for cashback (to offset card spend) or shopping/dining vouchers if you don’t want to travel right now.

38964 booked

38964 booked