Many travelers look for a UK tax refund for tourists, hoping to save on shopping during their trip. Searches like “UK tourist tax refund”, “how to get tax refund UK”, and “how to get tax refund in UK airport” are common but the rules have changed.

Since 2021, the UK has ended VAT refunds for most tourists, meaning you can no longer claim tax back at airports in Great Britain.

This guide explains what the change means, what limited options still exist, and how visitors can shop smarter in the UK today.

What Is the UK Tax Refund for Tourists?

The Tourist VAT Refund Is Basically Gone

The term “UK tax refund tourist” often refers to the idea that visitors to the UK can claim back the VAT (Value-Added Tax) on their purchases.

However, since January 1, 2021, the UK abolished the VAT Retail Export Scheme for most of Great Britain (England, Scotland, and Wales).

In other words: there is no more “UK tourist tax refund” in those parts of the UK. Many tourists are surprised to learn this when they try to claim VAT back.

That means you cannot walk out of a UK shop with goods and claim VAT back at the airport like in many European countries.

Some luxury stores (like Harrods, Selfridges, Harvey Nichols) offer a “shop and ship” service: you buy in-store, but the goods are shipped directly to your home country, and the VAT is deducted at point of sale.

Why Did the UK End Tourist VAT Refunds?

- The UK removed the scheme in 2021 (post-Brexit), which means many luxury brands and retailers have lobbied for its return.

- According to an economic analysis, reinstating the refund could bring back significant tourist spending.

Hotels in United Kingdom

Is There Any VAT Refund Scheme Left in the UK?

Yes, but it's very limited:

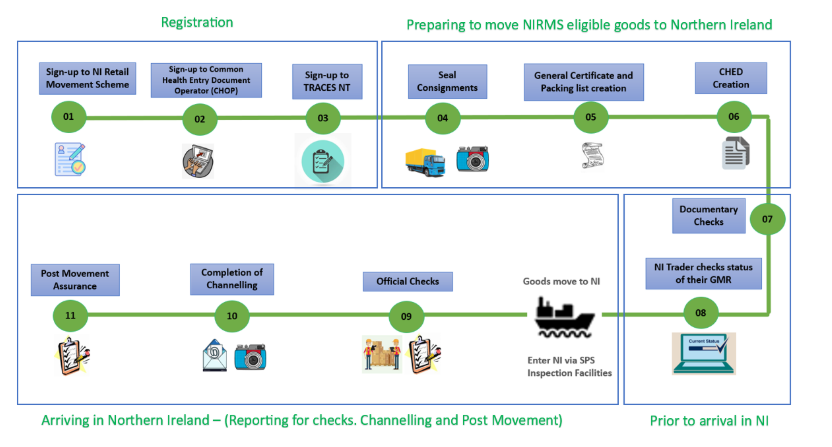

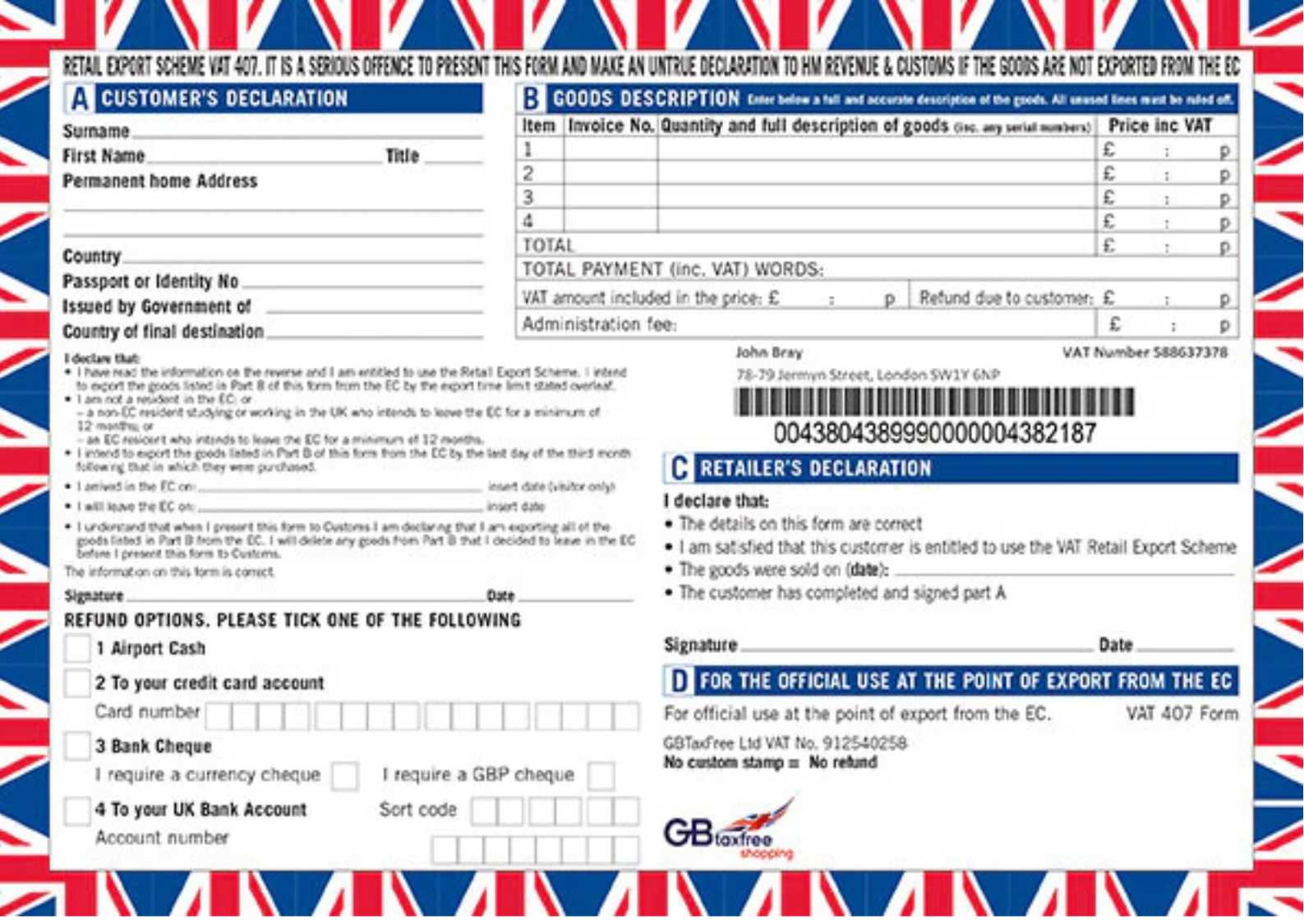

- The Retail Export Scheme (using VAT 407 forms) still exists in Northern Ireland.

- To use it as a non-UK, non-EU tourist:

Requirement

Description

Buy from a participating retailer

Only stores that offer the VAT 407 scheme can issue tax-free forms.

Complete the VAT 407 form at purchase

The retailer must fill out the VAT 407 document when you buy the item.

Get Customs validation when leaving NI/EU

At departure, Customs must stamp the VAT 407 form to confirm export before any refund can be processed.

- Once validated, you either:

- Go to a refund desk at the airport to claim your VAT back.

- Mail the stamped form back to the retailer or their refund agent so they can process your refund.

VAT for Non-UK Businesses (Business Refund Scheme)

Requirement / Step | Description |

|---|---|

Eligibility | Companies based outside the UK and not registered for VAT in the UK may claim back VAT on business-related goods and services purchased in the UK. |

Form Required | You must submit the VAT65A form to HMRC to apply for the refund. |

Deadline | Claims must be submitted within 6 months after the end of the relevant prescribed VAT year. |

Documents Needed | Original invoices showing VAT paid must be included with the application. |

Refund Method | Approved refunds are paid to the company’s bank account via SWIFT or local bank transfer. |

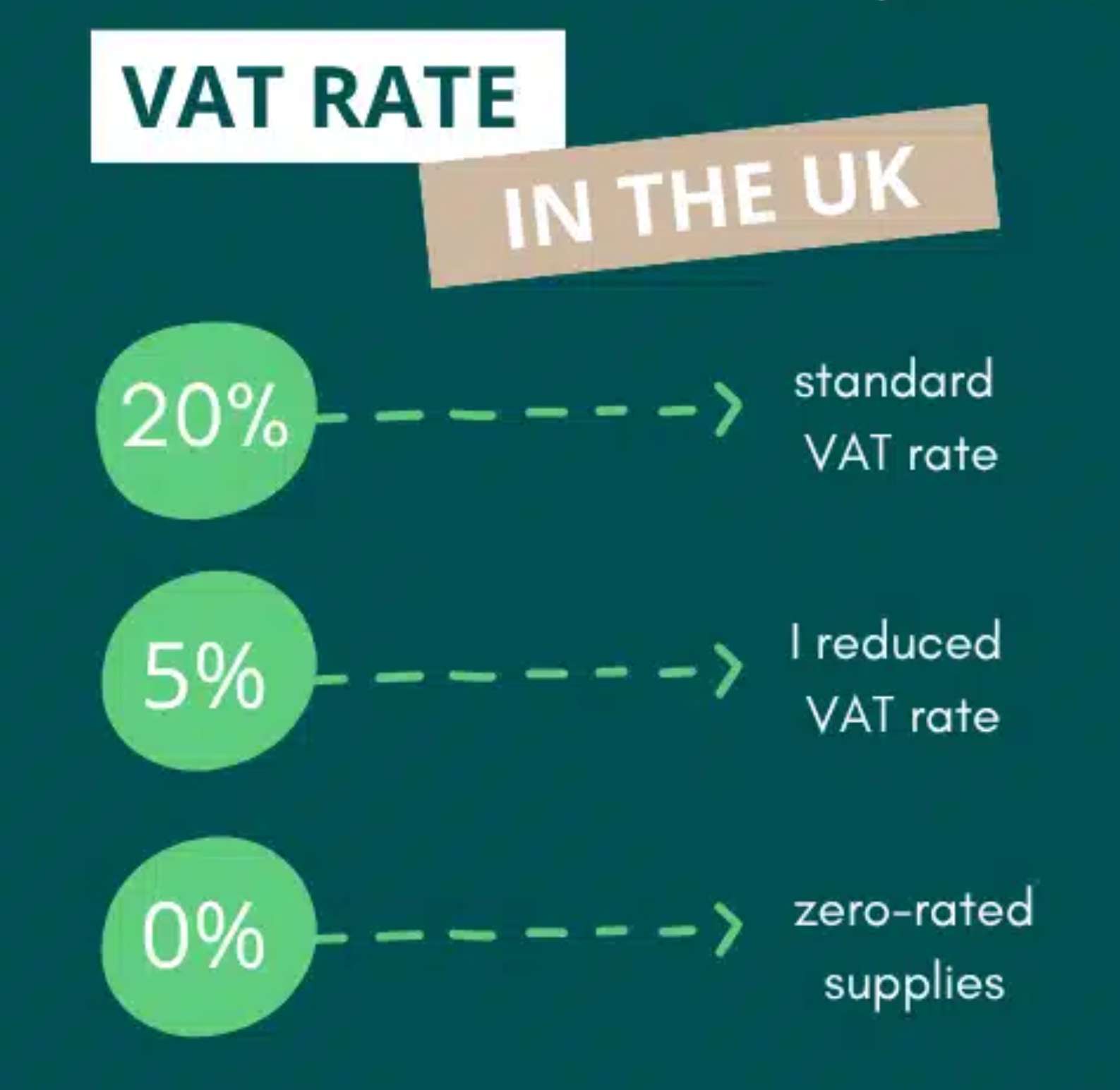

How Much Can You Get Back on VAT Rate

- The standard UK VAT rate is 20% for most goods and services.

- But remember: any refund scheme in Northern Ireland will charge administrative or handling fees, which are deducted from the VAT you’re reclaiming.

- According to GOV.UK, tourists cannot get a VAT refund for:

Not Eligible Item | Description |

|---|---|

Hotel stays or meals | Services such as accommodation, dining, and other consumable services cannot be claimed. |

Used goods | Items that have already been used or consumed are not eligible for VAT refund. |

Cars & second-hand goods | Motor vehicles and second-hand items (e.g., antiques) are excluded from VAT reclaim. |

Certain valuables | Specific precious metals or valuables that do not meet required weight or purity criteria cannot be claimed. |

How to Get Tax Refund in Northern Ireland

Although Great Britain no longer offers VAT refunds, Northern Ireland still operates the Retail Export Scheme using the VAT 407 form. Here’s exactly how to claim it:

Step 1: Shop at Participating Retailers

- Only selected stores in Northern Ireland offer tax-free shopping.

- Before buying, ask if they support the VAT 407 form.

Step 2: Complete the VAT 407 Form at Purchase

The retailer will issue a VAT 407 form that includes:

- Your personal details

- Passport information

- Purchase details

- VAT amount paid

Keep:

✔ The VAT 407 form

✔ Original receipts

Step 3: Get Customs to Stamp the VAT 407 Form

- This is the most important step, no stamp = no refund.

- At your departure point from Northern Ireland or the EU:

Requirement | Description |

|---|---|

Show your passport | Needed to verify that you are a non-UK, non-EU visitor eligible for tax-free shopping. |

Produce the goods | Items must be unused and available for inspection before export. |

Present receipts + VAT 407 form | Customs must check your purchase receipts and validate your VAT 407 form with an official stamp. |

- A Customs officer will stamp the form as proof of export.

Step 4: Submit the Stamped Form

After validation, you can claim the refund:

Option A — Airport Refund Desk (if available)

Some airports have a refund counter for immediate refund.

Option B — Mail the Form

Send the stamped VAT 407 form to:

- The retailer

- Their refund operator (e.g., Global Blue / Planet)

Refund is issued to:

Refund Method | Details |

|---|---|

Credit card | Refund is credited directly to your card after processing. |

Bank account | Refund is transferred via bank/SWIFT to your nominated account. |

Processing time | Refund typically takes 2–8 weeks, depending on the refund operator. |

Step 5: Receive Your VAT Refund

Once processed, you will receive VAT back minus handling fees.

VAT in the UK = 20%

Actual refund after fees = 8–14% depending on the operator.

Fly to Dublin

What Should Tourists Do Instead?

Ask about “ship to home” services

Asking whether the store offers international shipping (“shop & ship”) before purchase.

Some luxury stores (especially big department stores) may let you buy in-store and ship directly to your home country, effectively sidestepping VAT.

Compare prices with other European countries

Since tax-free shopping is more generous in many EU countries, it might be cheaper overall to buy there and claim VAT refund.

Comparing whether buying in nearby EU countries might give you a better tax refund benefit (if you’re planning to travel there too).

Keep receipts and check store policies

Even without a refund scheme, having good documentation helps if you need to justify purchases for other purposes (like insurance).

Checking also whether your total purchase is large enough for the store to make an exception or provide alternative VAT-reduced billing.

🔥Exclusive Hotels Deal: Up to 10% OFF for New Users

Discover the world with trip.com! Book the perfect hotel anywhere in the world and get an unbeatable 10% discount if you're a first-time user! Download our app now and start planning your next trip with ease.

✅ Summary

The UK tourist VAT refund scheme no longer applies in most of the UK, as it was officially ended in 2021. However, a limited refund system still exists in Northern Ireland through the VAT 407 form.

To claim a refund there, visitors must have their VAT 407 form validated by Customs and can then either collect the refund at the airport or mail the form back.

For most travelers, there is no longer a straightforward way to obtain a tax refund at UK airports, since the tourist VAT refund scheme has mostly been discontinued.

Consequently, there is no broad VAT refund scheme for tourists in Great Britain.

The only remaining option for non-residents is to ship purchases home through stores that support VAT refunds.

For non-UK businesses, certain VAT refund schemes remain active under specific conditions.

FAQ: UK Tax Refund

Can tourists get a VAT refund in the UK

Can tourists get a VAT refund in the UKHow do I claim a VAT refund in Northern Ireland?

Complete a VAT 407 form and have it validated by Customs. You can then collect your refund at the airport or mail the form back.Can I get a VAT refund in airports in Great Britain?

No, the general tourist VAT refund scheme no longer exists in Great Britain. Refunds at airports are no longer available.Are there alternative ways for non-residents to reclaim VAT?

Yes, some stores allow shipping purchases home with VAT refunded. This is the main option for non-residents outside Northern Ireland.Do non-UK businesses have VAT refund options?

Certain VAT refund schemes remain available for non-UK businesses under specific conditions.

NO.1

NO.1