Germany is one of Europe’s top shopping destinations, offering everything from luxury brands to electronics, fashion, and local crafts. The best part? Tourists from outside the EU can claim back part of the VAT (Value Added Tax) included in the purchase price.

Many travelers search for the Germany tax refund rate, how to calculate refunds, and ways to receive money back at the airport.

This guide explains everything you need to know clearly, simply, and with real expectations.

⭐ What Is the Germany Tax Refund Rate?

Germany has two VAT rates:

Category | VAT Rate |

|---|---|

Standard goods (fashion, electronics, luxury) | 19% |

Reduced goods (books, some foods, essentials) | 7% |

Realistic Germany Tax Refund Rate (After Fees)

So if you’re wondering “how much is the tax refund in Germany?”, normally, tourists will receive:

- 9%–13% refund on items with 19% VAT

- 3%–5% refund on items with 7% VAT

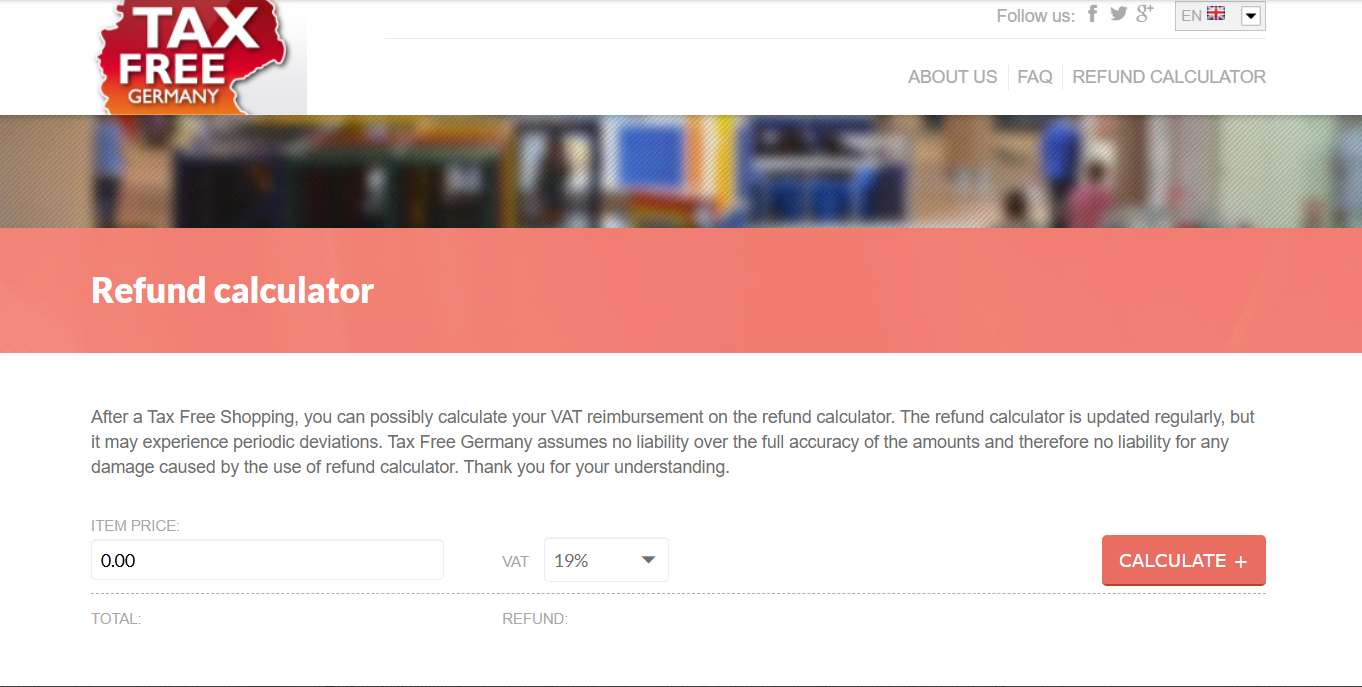

🧮 Germany Tax Refund Calculator

Although every refund operator (Global Blue, Planet, Innova) offers a tax refund calculator, you can estimate your return using this method:

Manual Calculation Formula

For example:

If you bought an item for €500:

- VAT amount: €79.83

- Refund after fees: approx. €45–€60

This explains why the Germany tax refund calculator often shows less than 19%.

Best Hotels in Germany

🌍 Who Can Get Tax Refund in Germany for Tourist?

You qualify if:

| Requirement | Description |

|---|---|

Non-EU Resident | You must live outside the European Union. |

Personal Use Only | Goods must be purchased for personal use, not resale. |

Departure Within 3 Months | You must leave the EU within 3 months of the purchase date. |

Exit Through International Airport/Border | You must depart Germany via an international airport or border checkpoint. |

Goods Must Be Unused | Items must remain unused and available for inspection. |

Original Receipts & Tax-Free Forms | You must present the original shop receipts and tax refund forms at customs. |

🛍️ Which Purchases Are Eligible?

| Eligible for Tax Refund | Not Eligible for Tax Refund |

|---|---|

Fashion & clothing | Hotels, restaurants, or cafés |

Jewelry & watches | Transport (train, bus, taxi) |

Beauty & skincare | Attraction tickets & tours |

Leather goods | Services |

Electronics | Opened or used items |

Home décor | Perishable foods consumed in Germany |

Souvenirs | — |

Lifestyle items | — |

✈️ How to Claim Tax Refund in Germany

Step 1: Shop at Tax-Free Stores

Look for signs such as:

- Global Blue

- Planet

- Innova Tax Free

- Tax Free Worldwide

At checkout:

- Show your passport

- Ask for the Tax Free Form

- Ensure the form includes your details & itemized purchase list

Step 2: Keep Receipts and Items Together

- Your tax refund form must be accompanied by the original receipt.

- Keep goods unused, with tags intact.

Step 3: Validate Your Tax-Free Form at the Airport

Before checking in your luggage:

- Go to the Customs (Zoll) counter

- Present:

| Item | Description |

|---|---|

Purchases | The goods you bought must be presented for inspection. |

Tax-Free Forms | Issued by the store; required for customs validation. |

Receipts | Original purchase receipts matching the forms. |

Passport | Proof that you are a non-EU resident. |

Step 4: Submit Your Stamped Form for a Refund

After security, visit the tax refund operator counter (Global Blue, Planet, etc.).

Refund options:

Refund Options

Method | Notes |

|---|---|

Cash | Instant but higher fees |

Credit card | Lower fees, refund in a few weeks |

Bank transfer | Available but slower & extra charges apply |

💰 How Much Tax Refund Can You Expect in Germany?

Although VAT is 19%, the actual refund after fees is usually 9%–13% of the purchase price.

Refund operators deduct:

- Processing fees

- Service charges

- Commission

Purchase | Germany VAT (19%) | Expected Refund |

|---|---|---|

€100 | €15.97 VAT | €8–€12 |

€300 | €47.90 VAT | €25–€38 |

€1,000 | €159.66 VAT | €90–€120 |

📍 Popular Shopping Cities in Germany

In Berlin

Kurfürstendamm (Ku’Damm)

One of Berlin’s most iconic shopping boulevards, lined with luxury brands, international fashion labels, department stores, cafés, and lifestyle shops. Ideal for high-end and mid-range shopping.

Alexanderplatz

A vibrant commercial hub featuring large malls like Alexa Shopping Center, electronics stores, fast-fashion chains, and local boutiques. Great for both budget-friendly and everyday shopping.

In Munich

Marienplatz

The heart of Munich, surrounded by arcades, souvenir shops, German brands, and traditional Bavarian boutiques. Perfect for picking up local crafts and fashion.

Maximilianstrasse

Munich’s luxury shopping district, home to premium labels such as Chanel, Dior, Gucci, and Louis Vuitton. A favourite for upscale and designer shopping.

In Frankfurt

Zeil Shopping Street (Die Zeil)

Known as Germany’s “Fifth Avenue,” this bustling street features major malls like MyZeil, department stores, electronics shops, and global fashion brands. A top destination for both high-street and premium shopping.

In Hamburg

Jungfernstieg

Outlet Shopping (Best for Discounts)

Wertheim Village (near Frankfurt)

A popular luxury outlet offering discounts on over 100 international brands such as Coach, Furla, Michael Kors, and Versace. Known for high savings and premium shopping experience.

Ingolstadt Village (near Munich)

Another top Designer Outlet hotspot featuring brands like Prada, Bally, Armani, and Tumi with year-round discounts. Perfect for travellers seeking tax-free savings plus outlet prices.

🧠 Tips to Maximize Your Germany Tax Refund

Cheap Flights to Germany

⚠️ Common Mistakes to Avoid

🔥Exclusive Hotels Deal: Up to 10% OFF for New Users

Discover the world with trip.com! Book the perfect hotel anywhere in the world and get an unbeatable 10% discount if you're a first-time user! Download our app now and start planning your next trip with ease.

🏁 Conclusion

The tax refund in Germany for tourists is a great way to save money, especially when purchasing luxury goods or electronics. Even though the Germany tax refund rate is officially 19%, tourists typically get back 9–13% after deductions.

By preparing properly, keeping receipts, validating forms at customs, and choosing the best refund option, you can maximize your savings and enjoy a smooth shopping experience.

FAQ: Tax Refund Germany

Who is eligible for a tax refund in Germany?

Non-EU residents who purchase goods in Germany for personal use and export them unused within 3 months.How much is the tax refund in Germany?

Germany’s VAT is typically 19% for most goods and 7% for select items. Your actual refund is slightly lower due to processing fees from operators like Global Blue or Planet.What is the minimum purchase amount for a tax refund in Germany?

Germany has no minimum spend requirement per receipt—you just need tax-free forms issued by eligible stores.Where do I validate my tax-free forms in Germany?

At the Customs (Zoll) counter in the departure airport before checking in your luggage.Can I get the refund in cash?

Yes, but cash refunds often come with higher fees. Credit card refunds usually give a better rate.What items are eligible for a Germany VAT refund?

Fashion, apparel, electronics, beauty products, jewelry, souvenirs, home goods, and more — as long as they remain unused when leaving the EU.What items are NOT eligible?

Hotels, food, transport, services, attraction tickets, and used/consumed items.Can I get a refund if I forgot to validate my forms?

No. Without the customs stamp, the VAT refund cannot be processed.

NO.1

NO.1