Shopping in Spain is already a highlight, think fashion brands, leather goods, cosmetics, and local souvenirs.

What many travellers don’t realise is that, as a visitor, you’re eligible for a Spain tax refund tourist scheme that lets you reclaim part of the VAT you paid before leaving the country.

I’ve gone through the process myself, and once you know how it works, claiming your refund is much easier than it sounds.

What Is the Spain Tax Refund?

Spain applies a Value Added Tax (VAT) to most goods, known as the Spain tax refund rate, which is typically 21%.

If you’re a non-EU resident, you can claim a VAT refund on items purchased in Spain and taken home outside the European Union.

This applies whether you’re shopping in Madrid, Barcelona, Seville, or Valencia.

Who Can Claim Spain Tax Refund as a Tourist?

You qualify for the Spain tax refund tourist program if:

Eligibility Requirement | Details |

|---|---|

Non-EU resident | You live outside the European Union |

Tourist visit | You’re visiting Spain temporarily |

Minimum spend met | You meet the minimum purchase requirement |

Goods exported | You export the goods unused outside the EU |

Minimum Spend Requirement in Spain

To qualify for a tax refund:

Tax Refund Requirement | Details |

|---|---|

Minimum spend | €90.16 per store per day |

Eligible retailers | Purchases must be from participating tax-free retailers |

Combined items | Multiple items can be combined on the same receipt from one store |

Spain Tax Refund Rate: How Much Can You Get Back?

The standard Spain tax refund rate is 21%, but you won’t receive the full amount due to processing fees charged by refund agencies.

So, how much tax refund in Spain can you expect?

On average, tourists receive:

The final refund depends on:

Calculation Factor | Description |

|---|---|

Purchase value | Total amount spent on eligible goods |

VAT rate | Spain tax refund rate, usually 21% |

Refund agency fees | Processing fees charged by refund providers (e.g. Global Blue, Planet) |

Spain Tax Refund Calculator: Example

Using a simple Spain tax refund calculator idea:

Example Calculation | Amount |

|---|---|

Total purchase | €1,000 |

VAT rate | 21% |

Estimated refund after fees | €100–€150 |

How to Claim Spain Tax Refund

Step 1: Shop at Tax-Free Stores

Look for “Tax Free Shopping” signs or ask staff.

Step 2: Request Your Tax Refund Form

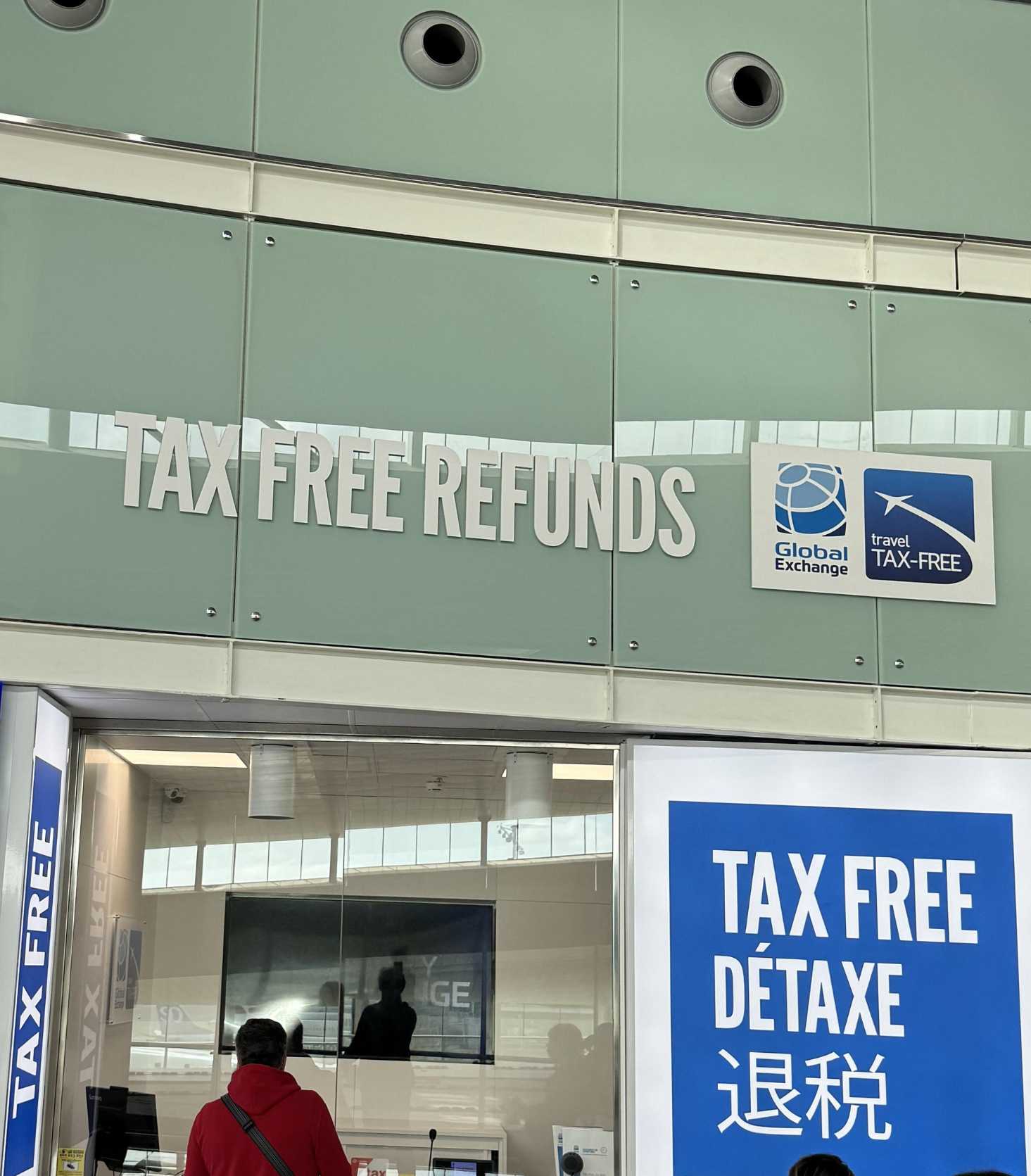

Step 3: Validate at the Airport

Before check-in:

- Use electronic kiosks, or

- Visit the customs desk if required

Step 4: Receive Your Refund

Choose between:

- Credit card refund (most common)

- Cash refund (available at selected counters)

🔥Exclusive Hotels Deal: Up to 10% OFF for New Users

Discover the world with trip.com! Book the perfect hotel anywhere in the world and get an unbeatable 10% discount if you're a first-time user! Download our app now and start planning your next trip with ease.

Where to Claim Tax Refund in Spain

Major airports like:

- Madrid-Barajas Airport

- Barcelona-El Prat Airport

have self-service validation machines and refund counters. Arrive early, especially during peak travel seasons.

Fly to Spain

What Items Are Eligible for Spain Tax Refund?

Common tax-free shopping items include:

Eligible Tax-Free Items in Spain | Examples |

|---|---|

Designer clothes and accessories | Fashion brands, bags, sunglasses |

Leather goods and shoes | Handbags, wallets, footwear |

Cosmetics and perfumes | Skincare, makeup, fragrances |

Electronics | Phones, gadgets, accessories |

Sealed food products and souvenirs | Olive oil, packaged sweets, gifts |

Final Thoughts

Understanding the Spain tax refund rate, using a simple Spain tax refund calculator, and knowing how much tax refund in Spain you can expect makes shopping far more rewarding.

If you’re a tourist planning to shop in Spain, don’t leave money on the table, claim your tax refund before you fly home.

FAQ: Spain Tax Refund for Tourists

What is the Spain tax refund?

The Spain tax refund allows non-EU tourists to reclaim part of the VAT paid on shopping in Spain. The standard Spain tax refund rate is 21%, though the actual refund received is usually lower after processing fees.Who is eligible for Spain tax refund?

You are eligible if you live outside the European Union, are visiting Spain temporarily, meet the minimum purchase requirement, and export the goods unused outside the EU.What is the minimum spend for Spain tax refund?

The minimum spend is €90.16 per store per day. Multiple items from the same store can be combined on one receipt.Where do I claim my Spain tax refund?

You can validate your tax refund at Spanish airports using electronic kiosks or customs counters, then receive your refund via credit card or cash depending on the provider.Is Spain tax refund worth it?

Yes, especially for higher-value purchases like fashion, leather goods, and electronics. The savings can add up quickly if you shop smart.