Shopping in Austria can be a delight, from designer boutiques in Vienna to charming local markets in Salzburg.

The good news for international travelers is that you can claim a VAT (Value Added Tax) refund on many of your purchases before leaving the country.

Whether you’ve splurged on luxury goods or picked up souvenirs, understanding how Austria’s tax-free shopping system works ensures you don’t miss out on valuable savings. This guide explains who qualifies, what receipts to keep, and how to claim your refund efficiently at the airport or border.

What is a Tax Refund / VAT Refund in Austria?

When you shop in Austria and live outside the European Union (EU), you may be eligible to reclaim the Austrian VAT you paid on certain goods when leaving the country.

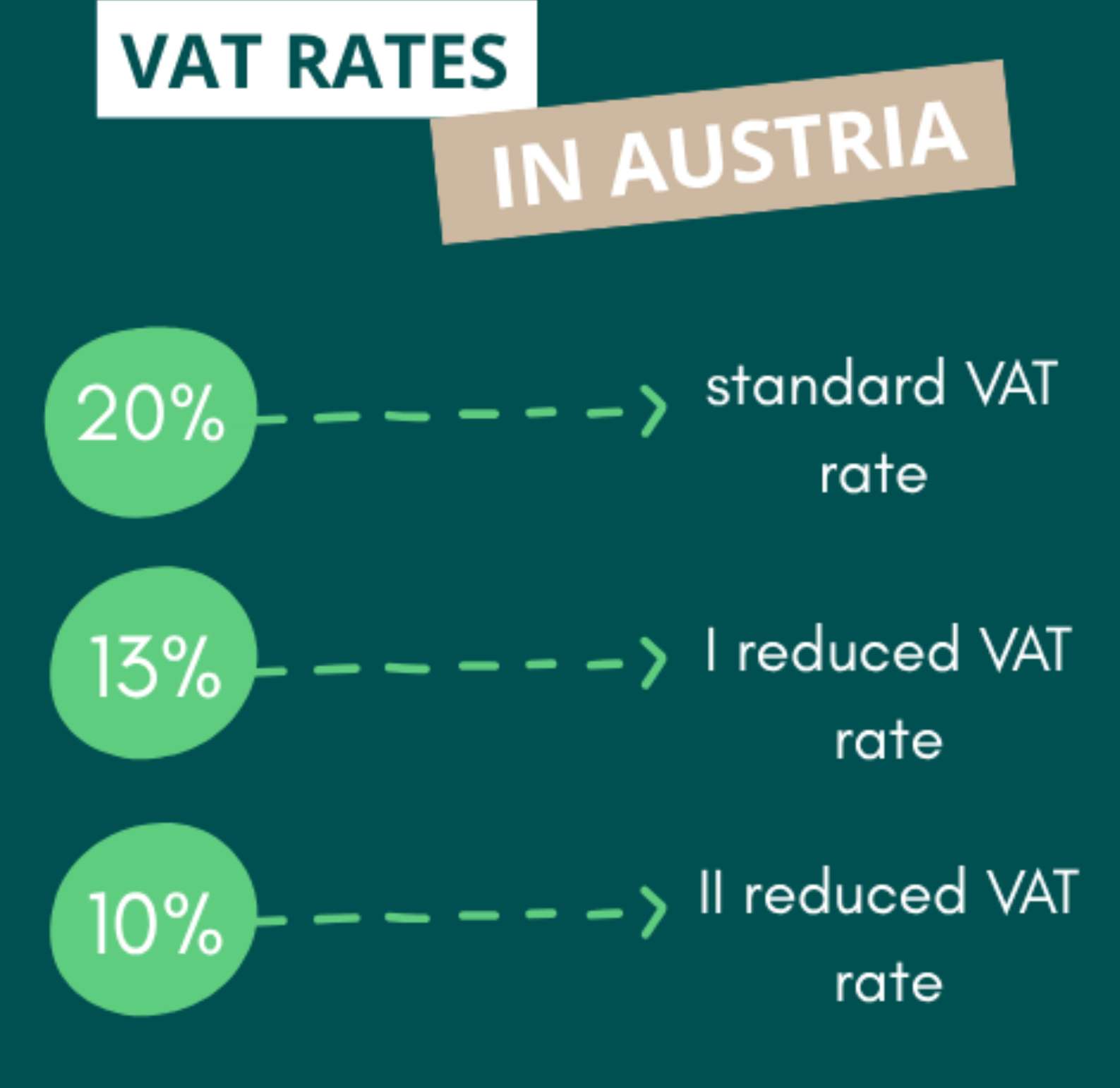

The standard Austria tax refund rate is 20% (with reduced rates for certain items).

How Much VAT Can You Get Back?

You won’t usually receive the full VAT amount, refund companies deduct handling fees, and you may incur foreign-exchange or card-processing charges.

Hence, you might receive around 15% of the purchase price back depending on circumstances.

Austria also has two reduced VAT rates:

| VAT Rate | Applies To |

|---|---|

10% | Most foodstuffs (excluding alcoholic beverages), books, newspapers, e-books, restaurant and catering services, water supplies, and passenger transport. |

13% | Certain goods and services including domestic flights, admission to sporting and cultural events, firewood, and the supply of living animals and plants. |

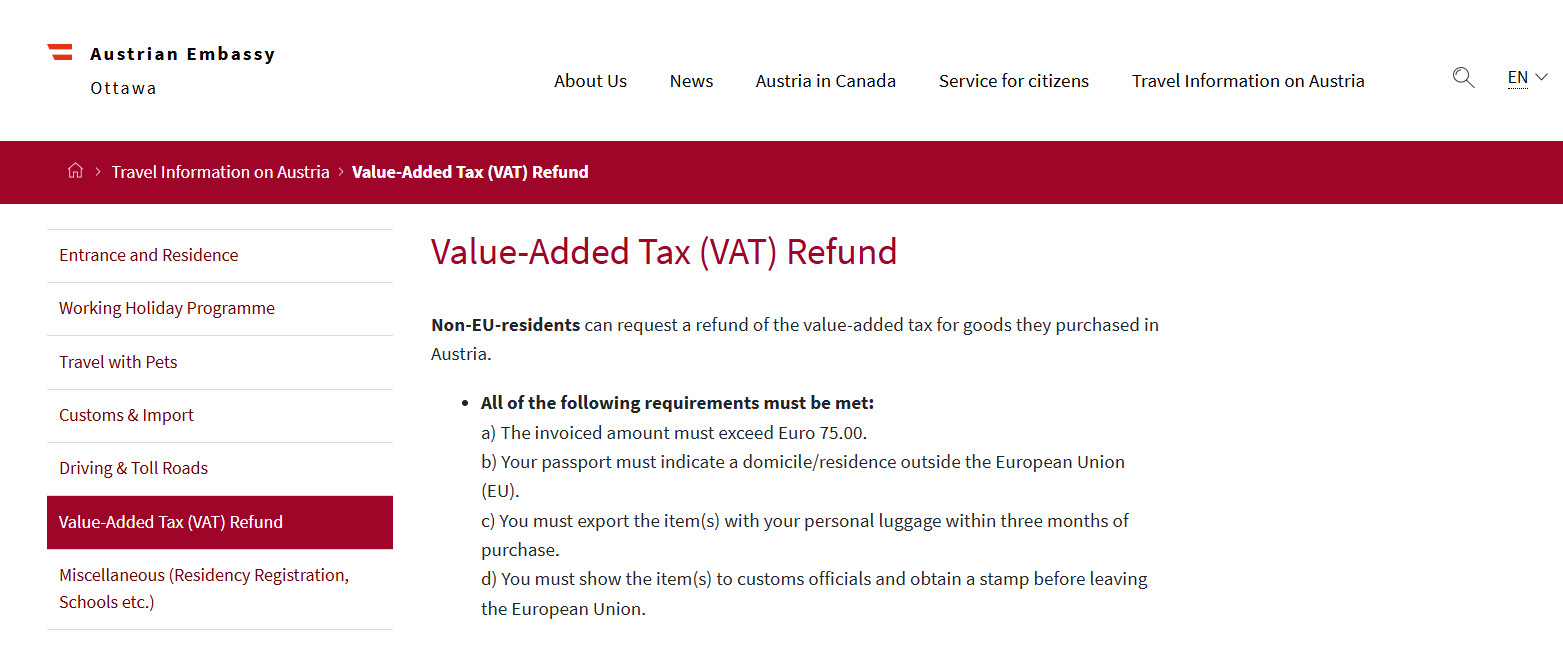

Who Can Claim?

To reclaim VAT on goods purchased in Austria, you must:

| Requirement | Details |

|---|---|

Non-EU Resident | You must have permanent residence or domicile outside the European Union (EU). Your passport or travel document must show a non-EU address. |

No EU Residence Permit | You must not hold a residence permit for Austria or any other EU member state. |

Minimum Purchase Amount | The total purchase price on a single invoice must exceed EUR 75.00 (EUR 75.01 or more). |

Export of Goods | Purchased goods must be exported in your personal luggage outside the EU within three months following the end of the purchase month. |

Customs Validation | You must obtain a customs stamp or digital validation on the U34 form (export certificate) at the final EU exit point. Goods must be presented unused to customs officials. |

Type of Goods | Refund applies only to goods for personal use, not for services (e.g., hotel stays or restaurant bills). |

What’s Not Eligible?

| Category | Description |

|---|---|

Goods Purchased by EU Residents |

|

Items Shipped Separately |

|

Fuel and Certain Consumables |

|

Services Instead of Goods |

|

Step-by-Step: How to Claim Your Refund

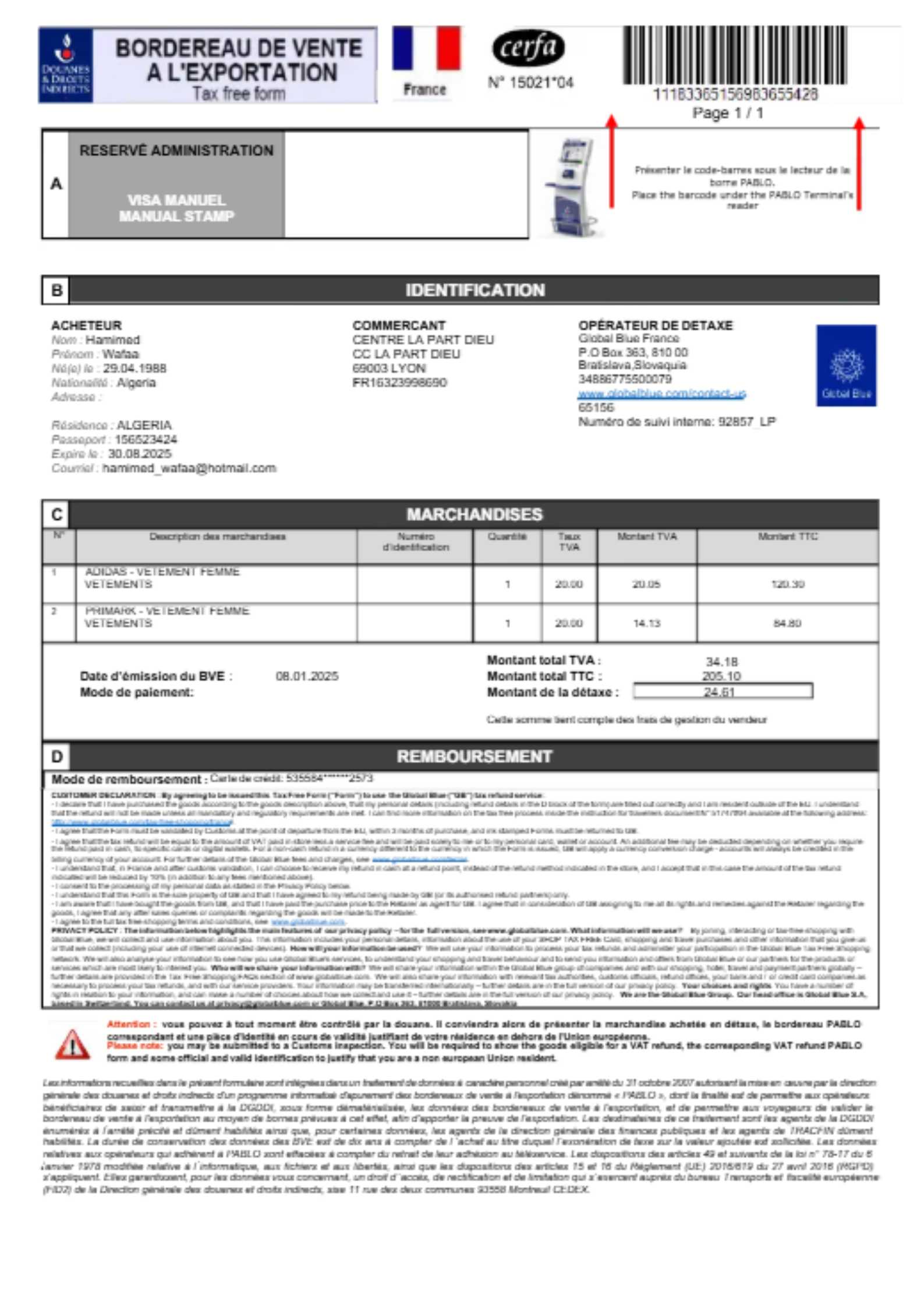

Step 1: At the Store

- Ask the retailer for the tax-free shopping form (usually Form U34). Ensure your purchase is tagged accordingly.

Step 2: When leaving Austria

- Present your goods, receipts/invoices and forms at customs.

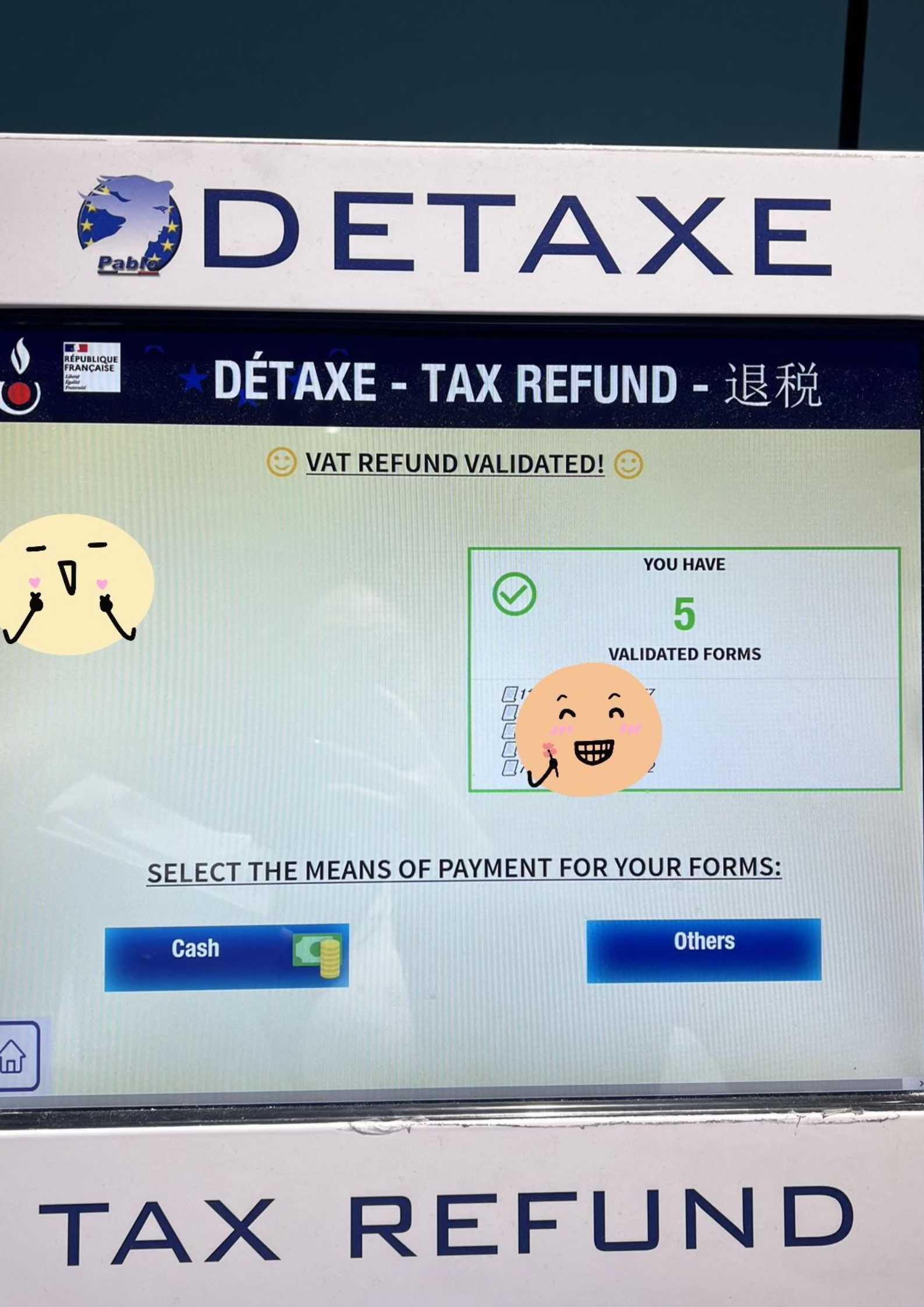

- In major airports (e.g., Vienna), a digital export validation (DEV) system is used.

Step 3: Submit your form

- After getting the export confirmation, you either take it to a refund desk (or drop-box) or mail it in, depending on the provider.

Step 4: Receive your refund

- Funds can be credited to your card, paid in cash (less common), or via bank transfer, check the provider’s method.

Flights to Vienna

Final Tips Before You Shop

Best Hotels in Austria

Safe Travel and Happy Shopping!

FAQ: Austria tax Refund

Who is eligible for a tax refund in Austria?

Non-EU residents who purchase goods worth over €75.01 in a single transaction and export them unused within three months are eligible for a tax refund.How can I claim my VAT refund in Austria?

Ask the retailer for a U34 tax-free form, get it stamped by customs when leaving the EU, and submit it to a refund agency (like Global Blue or Planet Tax Free) at the airport or online.What goods qualify for VAT refund?

Personal-use items such as clothing, electronics, and souvenirs qualify. Services like hotel stays or meals are not eligible.What is the VAT rate in Austria?

Austria has three VAT rates — 20% (standard), 13%, and 10%, depending on the type of goods or services.How long does it take to get the refund?

Refunds can take from a few days (for airport cash refund) to several weeks (for credit card refunds processed online).

NO.1

NO.1