Traveling abroad from Singapore is exciting, but hidden fees on overseas spending can quickly eat into your budget.

This guide is specifically for Singapore-based travelers and compares the best overseas spending cards, focusing on key factors such as transaction fees, foreign currency conversion rates, rewards programs, and global acceptance.

By choosing the right card, you can save money, earn rewards, and enjoy smooth, hassle-free payments wherever you go.

Top Picks for 2025

| Category | Card Name | Key Benefits | Why It’s Recommended |

|---|---|---|---|

Best for Air Miles | [Example: DBS Altitude Visa Signature] | Earn KrisFlyer or Asia Miles on every spend; bonus miles for overseas purchases | Ideal for frequent travelers who want to convert spending into flight rewards |

Best for No Fees | [Example: Standard Chartered Unlimited Cashback Card] | No foreign transaction fees; simple cashback on all purchases | Perfect for travelers who want to avoid hidden overseas charges |

Best for Beginners | [Example: Citi Rewards Card] | Straightforward rewards structure; widely accepted globally | Easy for first-time overseas card users with flexible rewards |

Best for Premium Rewards | [Example: UOB PRVI Miles Card] | High miles accrual, airport lounge access, travel perks | Suited for those who travel often and want luxury benefits |

Best for Multi-Currency Travel | [Example: OCBC 90°N Visa] | Reduced foreign currency conversion fees; works across multiple currencies | Great for travelers visiting multiple countries in one trip |

Popular Choices Among Singapore Travellers💖

Singapore travellers have become more selective when it comes to overseas spending cards.

Many prefer a mix of low fees, transparent exchange rates, and rewards that actually matter during a trip. Here are the cards most travellers rely on today, plus simple tips on how to make the most of each one.

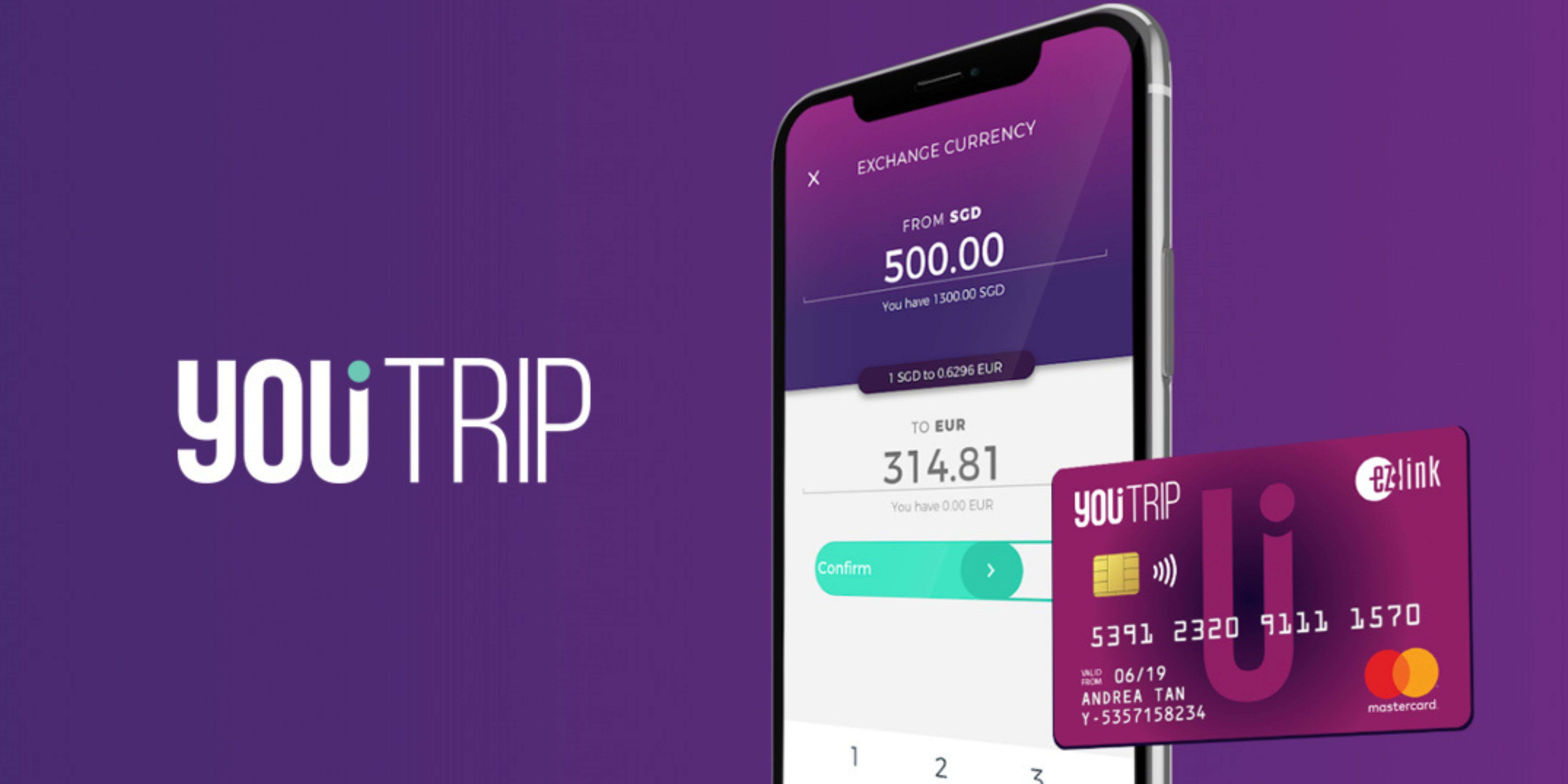

YouTrip

YouTrip is one of the most commonly used travel wallets because of its straightforward exchange rates and zero foreign transaction fees.

It allows you to store multiple currencies and lock in good rates before flying out.

Travel Benefits:

- No foreign transaction fees on overseas spend.

- Supports over 150 currencies for seamless travel.

- Lock in exchange rates in advance for predictable spending.

How to use it smartly:

- Exchange currency during off peak hours inside the app when rates are typically more stable.

- Use it for small to medium daily expenses like meals, transport, and shopping.

- Pair it with a miles credit card for big ticket bookings before your trip.

Wise Card

Wise is popular among long term travellers, digital nomads, and those who often pay for accommodation or tours overseas. It offers mid market rates, which are usually better than traditional banks.

Travel benefits:

- Lower ATM withdrawal fees compared to many debit cards.

- Supports large transactions at transparent rates.

How to Use It Smartly:

- Convert your currency inside the app a few days before payment to avoid sudden rate changes.

- Use Wise for larger transactions like accommodation or tour bookings to maximise savings.

Revolut

Revolut is great for travellers who want strong budgeting tools and easy control over their money. It supports both daily spending and money transfers, all tracked in real time.

Travel benefits:

- Instant card freezing if you lose it.

- In app analytics to track spending by category.

- Disposable virtual cards for extra security when making online bookings abroad.

How to Use It Smartly:

- Set daily or weekly spending limits in the app to manage your budget while travelling.

- Use it for online purchases to take advantage of disposable virtual cards.

HSBC Revolution

The HSBC Revolution is a favourite among travellers who want rewards without annual fees. You get 4 mpd on eligible online and contactless spending, which covers most overseas purchases.

Travel Benefits:

- Up to 4 mpd on eligible online and contactless spending overseas.

- No annual fee, making it cost effective for frequent travellers.

- Can be added to Google Pay or Apple Pay for convenient tap payments abroad.

How to Use It Smartly:

- Use it for dining, retail, and attraction payments to maximise rewards.

- Pay for larger overseas bills directly with the card to earn points quickly.

Citi PremierMiles

Citi PremierMiles is ideal for travellers who prioritise earning miles. It offers strong foreign spend rates and has a wide list of airline transfer partners.

Travel Benefits:

- Strong miles earn rates on all overseas transactions.

- Flexible airline transfer partners to redeem flights worldwide.

- Miles do not expire, making them ideal for long-term travel planning.

How to Use It Smartly:

- Use it for pre-trip bookings such as flights and hotels to earn the maximum miles.

- Pair with a multi-currency debit card for daily spending to avoid unnecessary fees.

Whether you're planning a road trip, a business journey, or just need a reliable ride, now is the perfect time to save. Use the coupon to enjoy this exclusive offer. Rent a car today and hit the road with extra savings!

How Do Travel Credit and Debit Cards Work🚈

Travel cards are designed to give you better rates, lower fees, and smoother spending when you are overseas. Most cards either convert your Singapore dollars to the foreign currency at the point of purchase or allow you to pre-load money in multiple currencies before your trip.

- Travel credit cards usually focus on rewards, miles, and travel perks.

- Travel debit or multi currency cards focus on real time exchange rates and low fees.

Here is how they generally work:

Currency Conversion

Some cards convert your SGD only when you make a purchase, while others let you exchange in advance at a locked rate.

Transaction Fees

Traditional bank cards often charge higher foreign transaction fees. Travel cards like YouTrip, Wise, and Revolut minimise or remove these fees.

Rewards and Miles

Credit cards such as Citi PremierMiles or UOB PRVI Miles offer miles for every dollar spent overseas.

Top Travel Credit and Debit Cards for Overseas Spend✈️

Card Name | Card Type | Key Highlights | Best For |

YouTrip | Multi currency debit wallet | No foreign currency fees, lock in rates, supports over 150 currencies | Daily overseas spending and budget travellers |

Wise Card | Multi currency debit card | Mid market exchange rates, low ATM fees, supports large transactions | Long trips and hotel or tour payments |

Revolut | Multi currency debit wallet | Good exchange rates, budgeting tools, instant card freeze | Travellers who want app control and easy tracking |

HSBC Revolution | Credit card | Up to 4 mpd on eligible spend, flexible rewards, no annual fee | Dining, shopping, attractions overseas |

Citi PremierMiles | Credit card | Good overseas miles earn rate, many airline partners | Frequent flyers and travel bookings |

UOB PRVI Miles | Credit card | High miles earn rate for foreign spend | Travellers focused on maximising miles |

DBS Multi Currency Account + DBS Visa Debit | Debit card linked to MCA | Preload multiple currencies at locked rates, low or no fees | Travellers who want control over conversion timing |

🔥Save More with an Extra 5% Off – New Users Only

Use our promo code to enjoy an extra 5% off (up to S$4) on your attraction tickets, eSIMs, and tours!

⏳ Redeem within 3 days of claiming

How to Pick the Best Card for Travelling✨

Before choosing, think about what matters the most during your trip.

Exchange Rate Transparency

Cards like YouTrip and Wise tend to show clearer and more accurate rates.This helps you avoid unexpected extra charges.

Rewards or Miles

If earning travel points is important, choose a card that gives strong overseas rewards. Miles cards like Citi PremierMiles offer long term value for frequent travellers.

ATM Access

Some destinations still rely heavily on cash. Wise is a practical choice if you plan to withdraw money overseas with lower fees.

App Features and Security

A good travel card should let you freeze your card instantly and monitor spending in real time. This adds peace of mind when moving around crowded tourist areas.

Final Thoughts😀

Picking the right overseas spending card depends on your travel habits and budget.

Whether you prefer great rewards, strong exchange rates, or low fees, using a smart card combination can help stretch your travel money further and make your overseas trip smoother.

FAQs for Best Cards for Overseas Spends

Can I use my regular Singapore credit card overseas?

Yes, but many traditional cards charge foreign transaction fees and offer less competitive rates. Travel-specific cards often save you money.Should I carry cash or rely on cards abroad?

Both. Cards are convenient, but some destinations still prefer cash. Travel cards with low ATM fees like Wise are useful for withdrawals.How do I avoid hidden fees when spending overseas?

Always pay in local currency, check foreign transaction fees, and use a travel wallet or card with transparent rates.Should I have a backup card while travelling?

Always. Network issues, blocked cards, or unexpected limits can happen, so carrying a second travel card is recommended.