If you’re visiting Singapore and love shopping for luxury goods, gadgets, or souvenirs, there’s great news, you can get a refund on the GST (Goods and Services Tax) you pay while shopping! This Singapore tax refund program lets tourists save money by claiming back the 9% GST before leaving the country.

Here’s your ultimate guide on how to claim tax refund in Singapore, including how it works, eligibility, refund process, and a simple Singapore tax refund calculator to estimate how much you can get back.

What Is the GST Tax Refund in Singapore?

The GST (Goods and Services Tax) is a 9% tax applied to most goods and services in Singapore. Under the Tourist Refund Scheme (TRS), visitors can claim tax refund in Singapore for eligible purchases made at participating shops.

So if you’ve spent a few hundred dollars shopping, you can easily recover part of it at the tax refund Singapore airport counters before your flight.

👤Who Can Claim Tax Refund in Singapore?

You are eligible for a Singapore tourist tax refund if you:

| Eligibility Criteria | Description |

|---|---|

🧳 Tourist Status | Must be a non-resident tourist, not a Singapore citizen or permanent resident. |

💰 Minimum Spending | Spent at least SGD 100 (including GST) in a single day at one or more participating stores. |

✈️ Departure Point | Must depart Singapore via Changi Airport or Seletar Airport to claim the refund. |

📅 Purchase Validity | Goods must be taken out of Singapore within two months from the purchase date. |

🎁 Goods Carried Out | You must carry the goods with you when leaving Singapore (not shipped or used locally). |

🛍 How to Get Tax Refund in Singapore

Here’s how tourists can easily claim GST tax refund Singapore at the airport:

Step | Description |

|---|---|

1. Shop at eTRS-Registered Stores | Look for the “Tax-Free”, “Global Blue”, or “eTRS” logo. Present your passport during payment so the purchase is linked to your passport. |

2. Visit the eTRS Kiosk at Singapore Airport | At Changi or Seletar Airport, head to the Electronic Tourist Refund Scheme (eTRS) self-help kiosk before check-in. |

3. Scan and Verify Purchases | Use your passport or eTRS ticket to access purchase records. Review your items and confirm eligibility. |

4. Submit and Choose Refund Method | Choose between credit card refund, Alipay/WeChat Pay, or cash refund (Travelex counter). |

5. Customs Inspection (if needed) | For high-value goods, customs officers may inspect your items before approving the refund. |

💵 How Much Tax Refund in Singapore?

You can claim back up to 9% of your total purchase amount, but refund operators may deduct a small handling fee (usually around 1.5–2%).

Example Calculation (Singapore Tax Refund Calculator for Foreigners)

Total Purchase (SGD) | GST (9%) | Approx. Refund After Fee |

|---|---|---|

SGD 200 | SGD 18 | SGD 16 |

SGD 500 | SGD 45 | SGD 42 |

SGD 1,000 | SGD 90 | SGD 86 |

💳 Refund Methods & Processing Time

Refund Method | Processing Time | Notes |

|---|---|---|

Credit Card | 10–14 working days | Refund credited to the card used for purchase |

Alipay / WeChat Pay | 3–5 working days | Fast and paperless |

Cash (Travelex Counter) | Instant | Available at tax refund Singapore airport counters |

📍 Where to Claim Tax Refund in Singapore Airport

Changi Airport:

Changi Airport:

- eTRS self-help kiosks located before and after immigration in Terminals 1–4

- Travelex counters available for cash refund collection

Seletar Airport:

- eTRS kiosk near check-in area (limited service)

🚫 What’s Not Eligible for Tax Refund

| ❌ Not Eligible for Tax Refund | Description / Example |

|---|---|

🍽 Food & Beverages | Meals, snacks, or drinks consumed while in Singapore. |

🏨 Accommodation | Hotel stays, serviced apartments, or lodging costs. |

💆♀️ Services | Spa treatments, massages, transport services, guided tours, or event tickets. |

📦 Shipped Goods | Items sent overseas by courier or mail instead of carried with you. |

👜 Partly Used Goods | Products already used or opened while still in Singapore. |

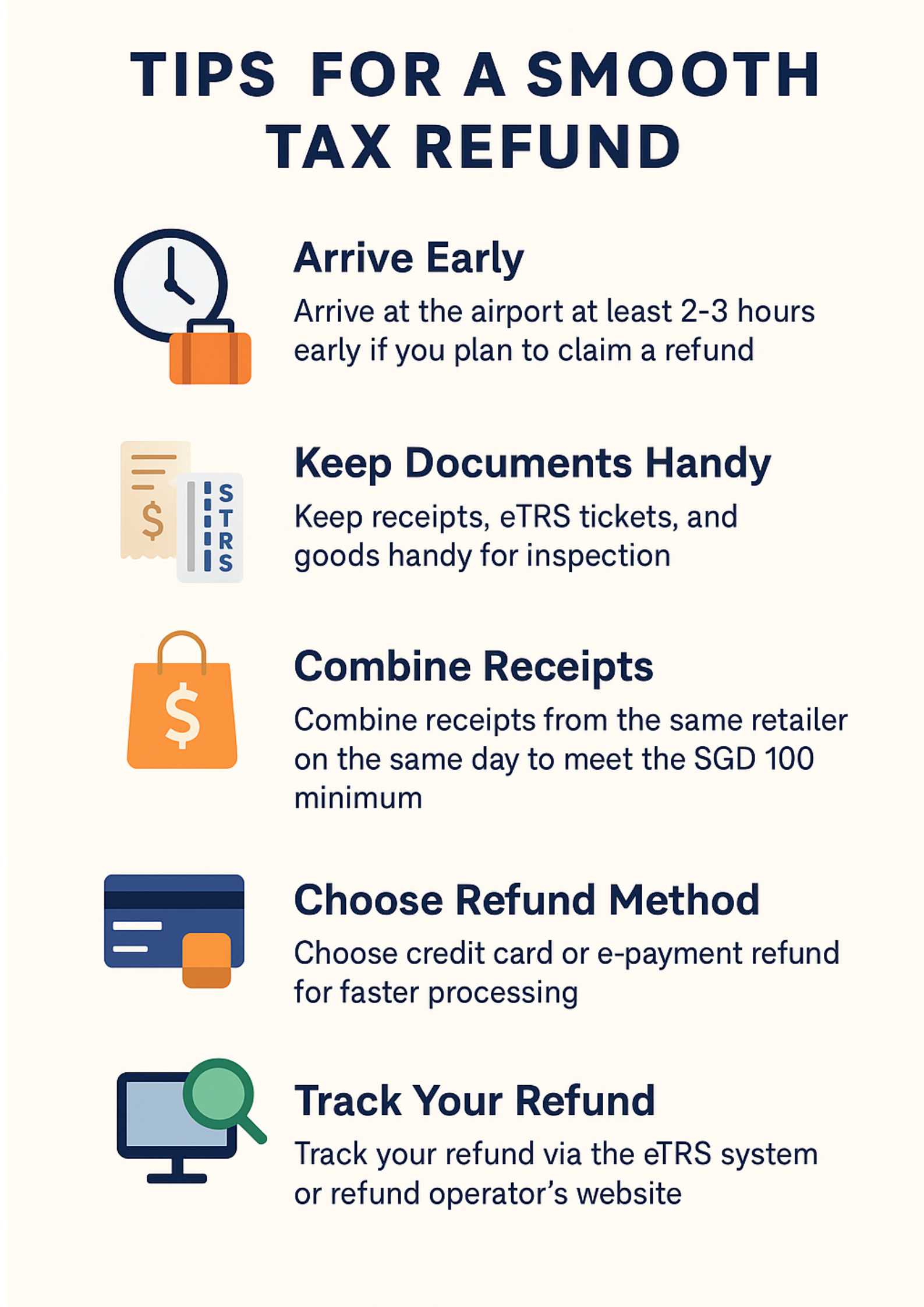

🕒 Tips for Smooth Refund Processing

Top Hotels in Singapore

Conclusion

The GST refund for tourists is a simple yet rewarding benefit for tourists in 2025. By understanding the rules and following the right steps on how to claim GST refund in Singapore, you can maximize your shopping savings before flying home. So next time you’re in Singapore, shop smart, claim your GST refund, and enjoy more value from every purchase.

You can also save money on your purchases in Singapore and make the most of your trip. Just remember to keep your receipts and follow the application process before you leave the country.

Cheap Flights From Singapore

Refund for Tourists in Singapore

How do I know if a shop offers GST refund?

Look out for signs that say “Tax-Free” or “GST Refund” at the store. Always check at the cashier before making payment.Can I claim GST refund if I leave by land or sea?

No. GST refunds are only available if you depart from Changi Airport or Seletar Airport. Departures via land checkpoints or ferries are not eligible.How long do I have to take the goods out of Singapore?

You must bring the goods out of Singapore within 2 months from the date of purchase.How will I get my refund?

You can choose either credit card refund or cash refund at the airport. Credit card refunds are usually faster and more convenient.What happens if I lose my receipt?

Without a valid receipt and eTRS ticket, you cannot claim GST refund. Always keep your receipts safe until your departure.

NO.1

NO.1