Australia offers international travelers the chance to reclaim taxes on their shopping through the Tourist Refund Scheme (TRS).

If you’re planning a trip down under, knowing how much tax refund for tourists in Australia and using an Australia tourist tax refund calculator can help you maximize your savings.

What is the Australia Tourist Tax Refund?

The Tourist Refund Scheme (TRS) allows eligible international visitors to claim back the Goods and Services Tax (GST) and Wine Equalisation Tax (WET) paid on purchases made in Australia.

It’s a great way to make shopping in Australia more affordable and rewarding.

Who is Eligible for a Tax Refund in Australia?

To claim your tourist tax refund in Australia, you must:

Requirement | Description |

|---|---|

Departure Timeframe | You must be leaving Australia within 60 days of purchase. |

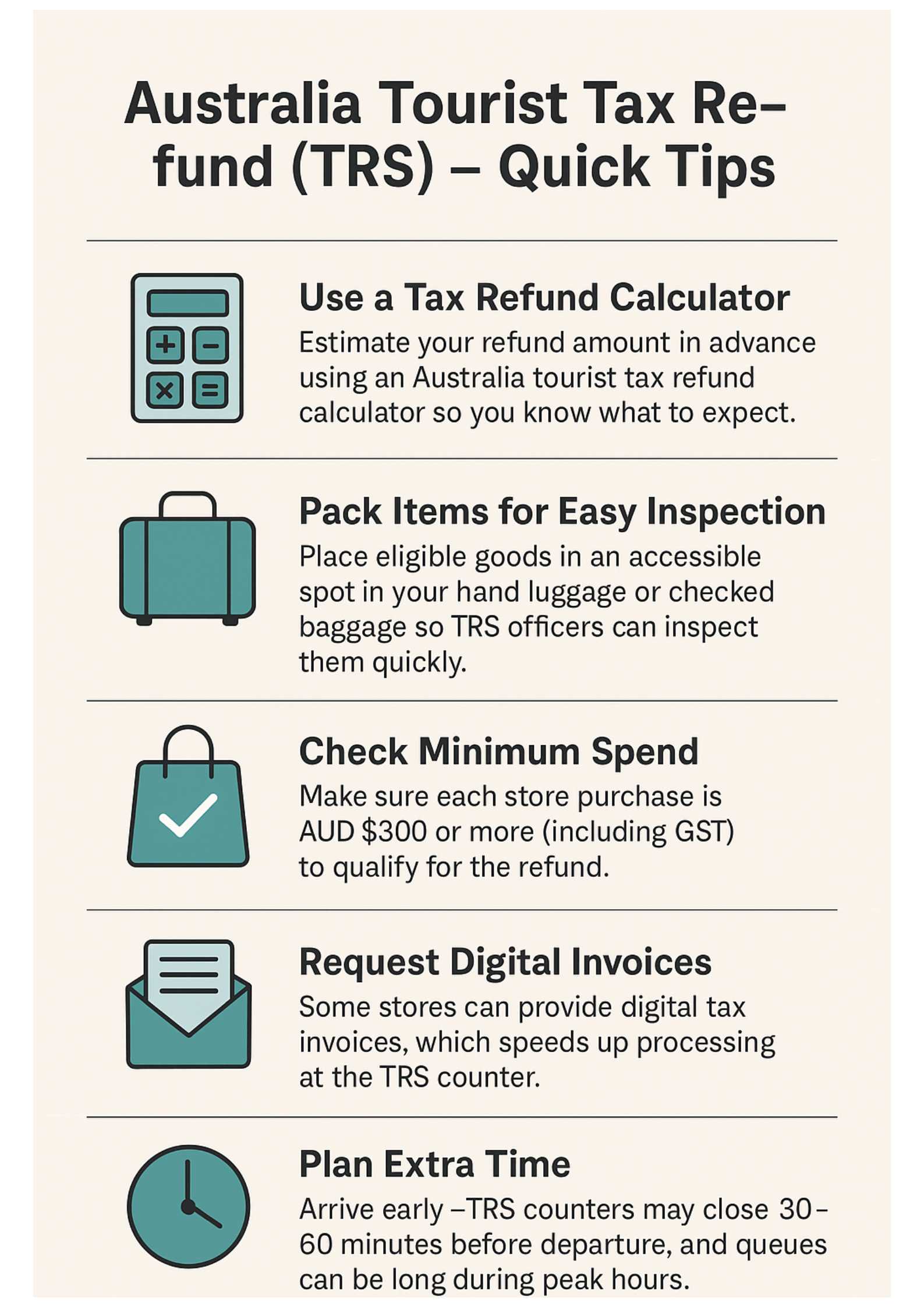

Minimum Spend | Spend AUD $300 or more (including GST) in a single store on eligible goods. |

Carrying the Goods | Goods must be carried in your hand luggage or checked baggage when departing. |

Required Documents | Present your tax invoices, passport, and boarding pass at the TRS counter. |

How Much Tax Refund Can Tourists Get in Australia?

The refund depends on the GST and WET you’ve paid on eligible goods:

Tax Type | Refund Rate | Description |

|---|---|---|

GST (Goods and Services Tax) | 10% of the purchase price | Applies to most eligible goods purchased in Australia. |

WET (Wine Equalisation Tax) | 14.5% of the purchase price (refunded in addition to GST) | Applies only to eligible wine purchases under the TRS. |

Step-by-Step Guide to Claiming Your Tax Refund

Step 1: Shop at Participating Stores

- Ask the retailer for a tax invoice at the time of purchase and ensure they participate in the TRS.

Step 2: Keep Your Goods and Receipts

- Keep all receipts together and ensure goods are unused.

Step 3: Arrive Early at the Airport

- TRS counters are busy and lines can be long, so give yourself extra time before your flight.

Step 4: Go to the TRS Counter

- Present your passport, boarding pass, tax invoices, and goods.

- Goods may be inspected, especially if they are carry-on items.

Airports with TRS Counters in Australia

Most major international airports have TRS counters:

Airport City | Airport Code |

|---|---|

Sydney | SYD |

Melbourne | MEL |

Brisbane | BNE |

Perth | PER |

Adelaide | ADL |

Cairns | CNS |

Step 5: Choose Refund Method

- Cash (AUD): for immediate refund

- Credit card: (may take 2–8 weeks)

Fly to Australia

Tips for a Smooth Refund Process

Best Hotels in Australia

Conclusion

The Australia tourist tax refund is an excellent opportunity for international travelers to save money on shopping.

By using an Australia tourist tax refund calculator, knowing how much tax refund for tourists in Australia you can expect, and preparing your receipts and goods, you can ensure a smooth and profitable refund process.

FAQ: Tourist Tax Refund in Australia

What is the Tourist Refund Scheme (TRS) in Australia?

The TRS allows international travelers to claim back GST and WET paid on eligible goods purchased in Australia, as long as the items are taken out of the country.Who can claim a tourist tax refund in Australia?

Anyone departing Australia on an international flight who purchased eligible goods worth AUD $300 or more from the same store within 60 days before departure.How much tax refund can tourists get in Australia?

Tourists can claim 10% GST and 14.5% WET (for wine) on eligible purchases. The total amount depends on what you bought.What documents do I need for the TRS refund?

You need your passport, boarding pass, tax invoices, and the goods for inspection.Where do I claim my tourist tax refund in Australia?

Claims must be made at TRS counters located in major international airports including Sydney, Melbourne, Brisbane, Perth, Adelaide, and Cairns.Do I need to show the goods at the airport?

Yes. Goods must be available for inspection, especially if carried in hand luggage. If checked in, show them before checking your bags.How long does the refund take?

Cash refunds are immediate. Credit card refunds may take 2–8 weeks depending on bank processing times.Can digital receipts be used?

Yes. Many stores now issue digital invoices, which are accepted at TRS and can speed up processing.When should I arrive at the airport to claim TRS?

Arrive early—TRS counters may close 30–60 minutes before departure, and lines can be long during peak times.Are food, hotels, or services eligible for TRS?

No. Only tangible goods taken out of Australia qualify. Services like tours, meals, or hotel stays are not eligible.

NO.1

NO.1