If you’re planning to shop in Bangkok, Chiang Mai, Phuket, or Pattaya, the Thailand Tax Refund for Tourist program is a great way to save money.

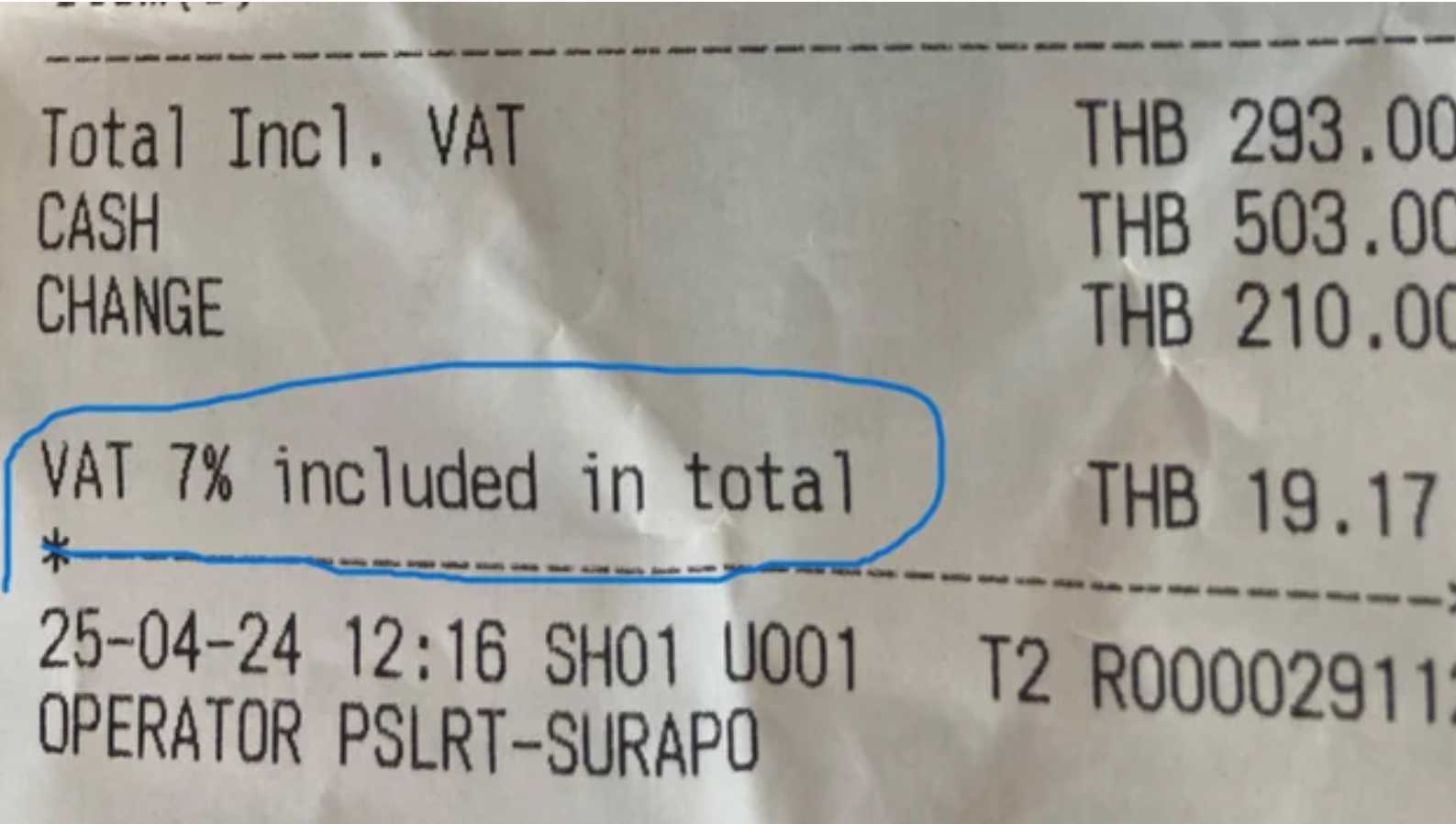

Under this system, eligible travelers can claim back part of the 7% VAT added to most goods sold in Thailand.

This guide explains the Thailand tax refund rate, who qualifies, and how to claim tax refund in Thailand step-by-step, with helpful tips to maximize your refund.

⭐ What Is the Thailand VAT Refund for Tourists?

The VAT Refund for Tourists is a program that allows non-Thai residents to claim back 7% Value Added Tax (VAT) on purchases made at participating stores.

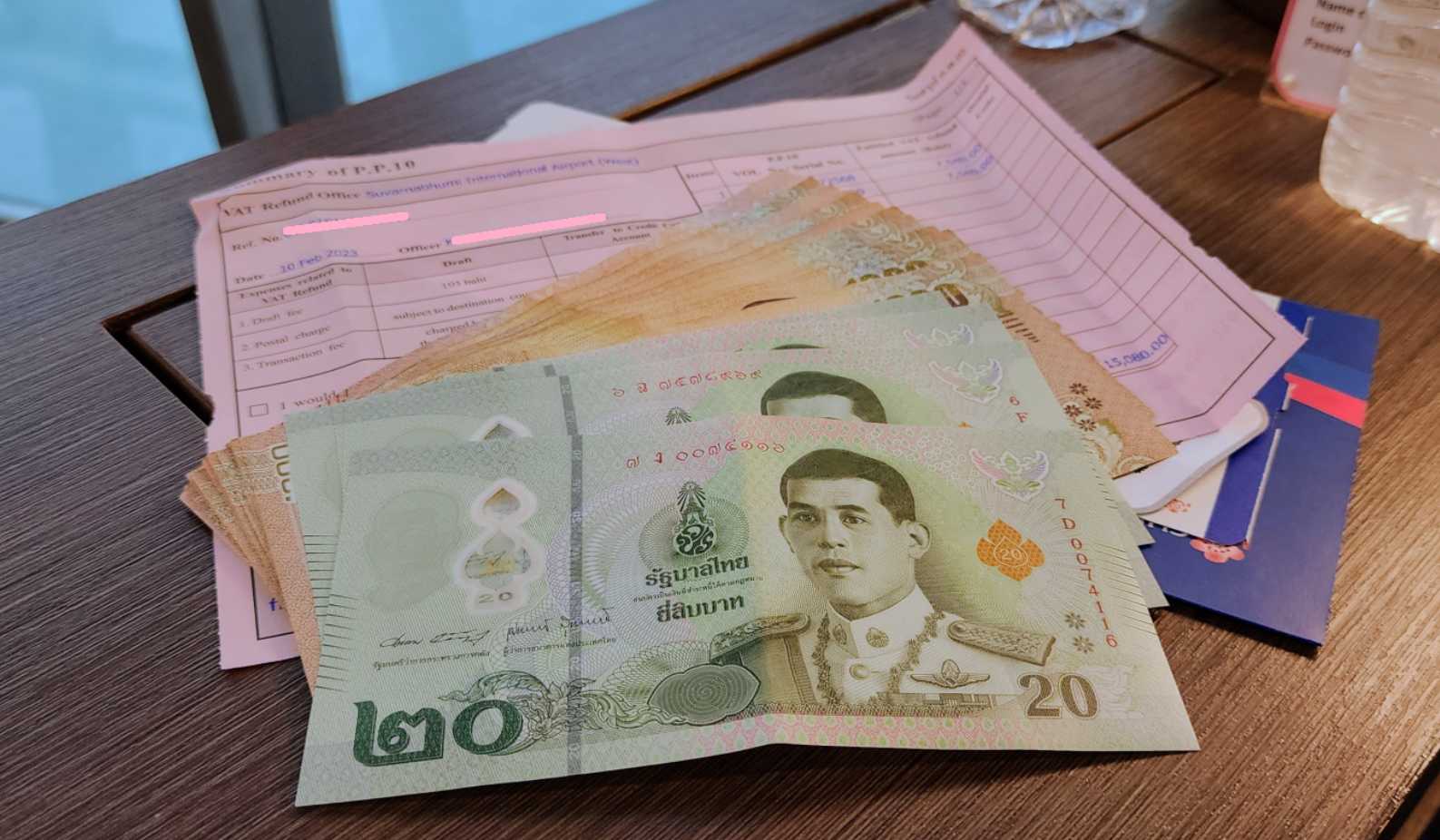

Refunds are processed at Thailand’s international airports when departing the country.

💰 Thailand Tax Refund Rate

Thailand’s VAT is 7%, but tourists receive less than 7% back due to administrative and processing fees.

Typical Refund Amount You Receive

Purchase Price (THB) | Approx. Refund You Get |

|---|---|

2,000 THB | ~120–140 THB |

5,000 THB | ~300–350 THB |

10,000 THB | ~500–600 THB |

20,000 THB | ~1,000–1,200 THB |

🛍️ Who Is Eligible for Thailand Tax Refund for Tourists?

You must meet all conditions below:

| Requirement | Details |

|---|---|

Tourist Status | You must not be a Thai citizen or Thai resident. |

Departure Point | Must depart Thailand through an international airport (land borders & seaports not eligible). |

Eligible Stores | Goods must be bought from shops displaying the “VAT Refund for Tourists” sign. |

Minimum Spend per Store/Day | Spend at least 2,000 THB at each store on the same day. |

Total Minimum Spending | Minimum total eligible purchase of 5,000 THB or more. |

Export Deadline | Goods must leave Thailand within 60 days of purchase. |

Condition of Goods | Items must be unused and available for inspection at the airport. |

🛒 Eligible vs. Not Eligible Items for Thailand Tax Refund

| Category | Items |

|---|---|

Eligible Items | Fashion & apparel, Jewelry, Electronics, Cosmetics/beauty & skincare, Leather goods, Watches & accessories, Souvenirs, Home décor items |

Not Eligible Items | Services (spa, hotels, massage, tours), Food & beverages consumed in Thailand, Used or opened items, Precious gems without proper certification |

🔥Exclusive Hotels Deal: Up to 10% OFF for New Users

Discover the world with trip.com! Book the perfect hotel anywhere in the world and get an unbeatable 10% discount if you're a first-time user! Download our app now and start planning your next trip with ease.

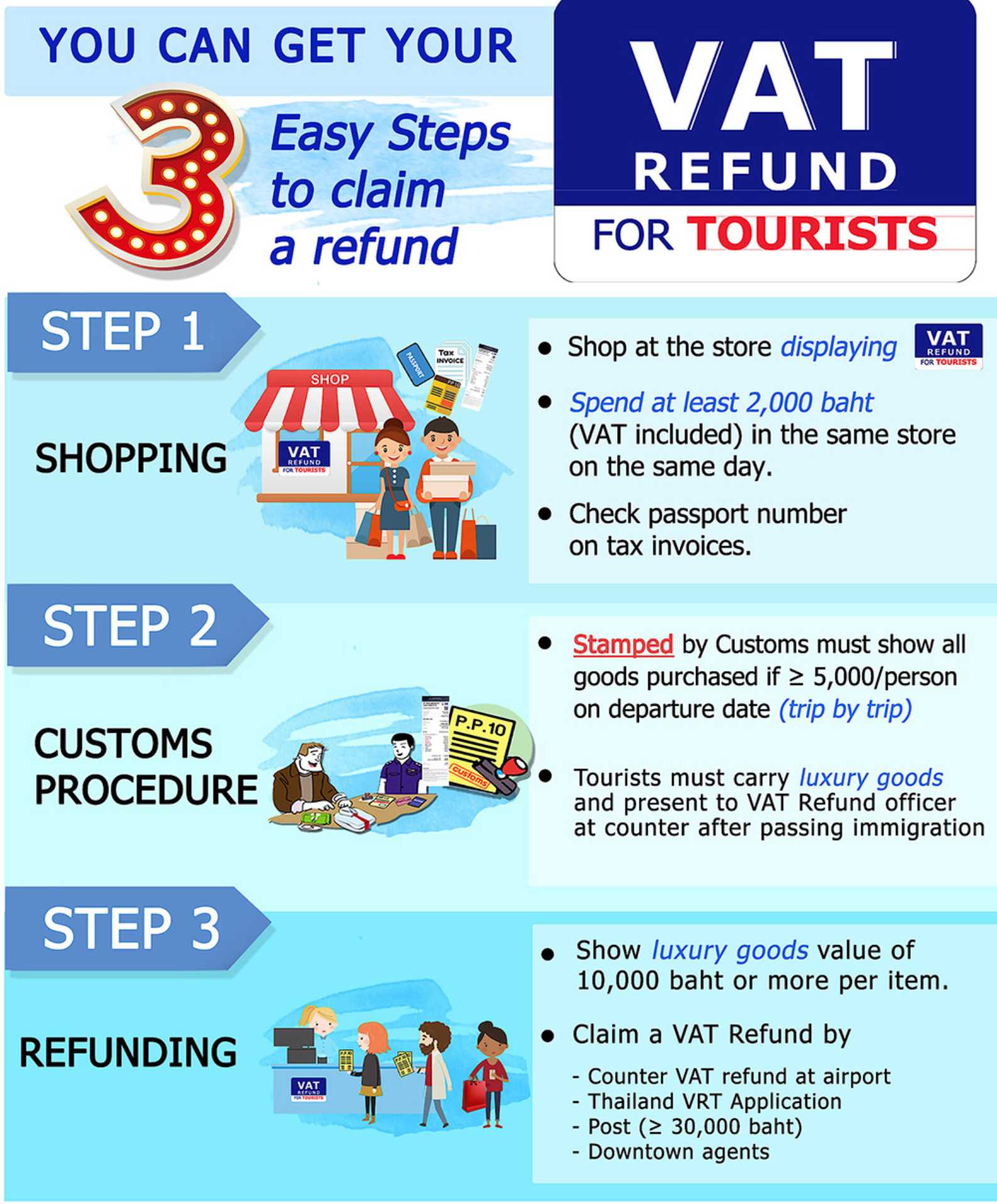

🧾 How to Claim Tax Refund in Thailand: Step-by-Step Guide

Below is the full process for how to claim tax refund in Thailand as a tourist.

Step 1: Shop at Stores with “VAT Refund for Tourists” Sign

Only participating stores can issue VAT refund forms.

At checkout:

- Present your passport

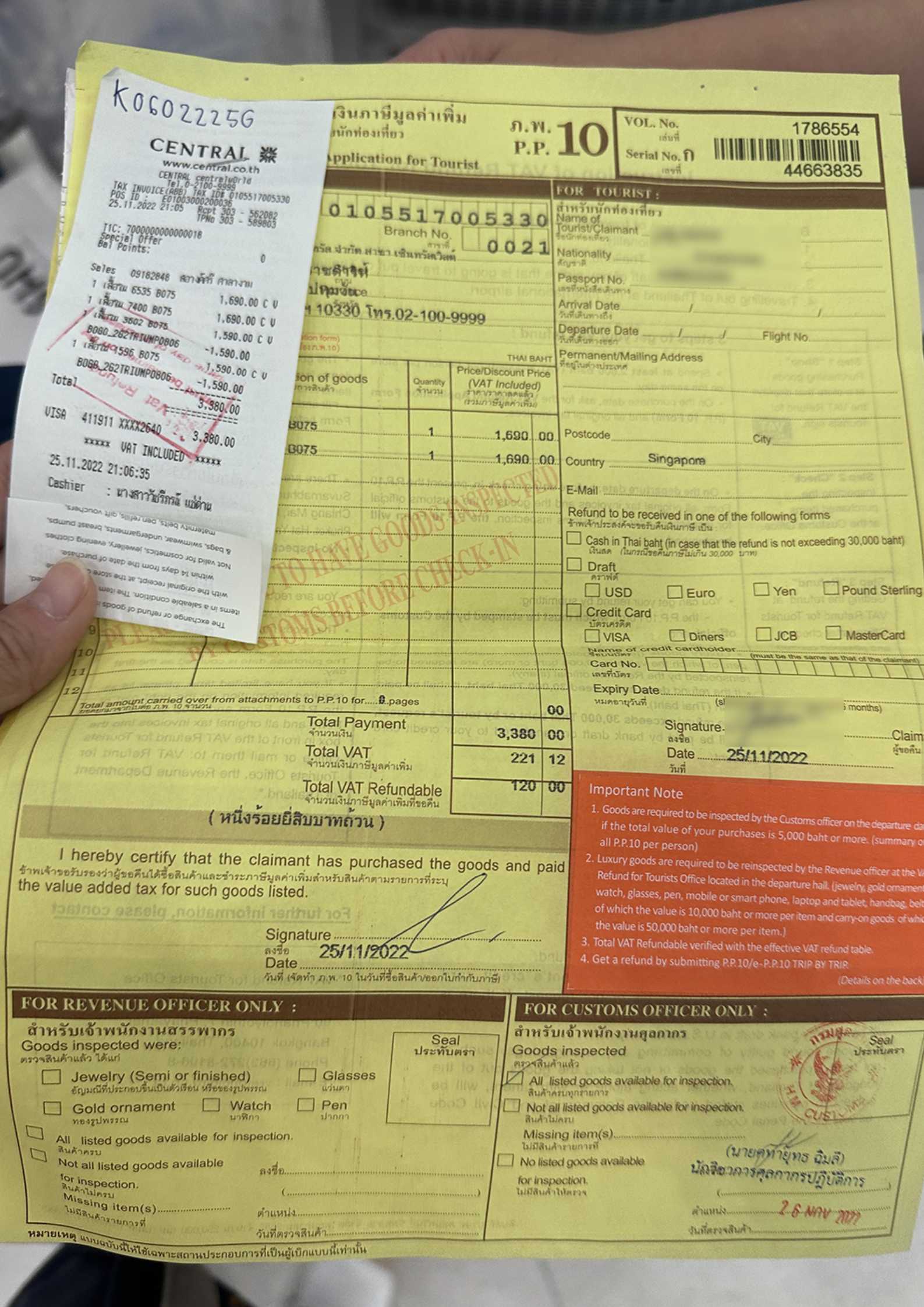

- Request the P.P.10 form (VAT refund form)

- Ensure store details and your passport info are correct

Step 2: Keep Receipts & Forms Together

You must keep:

- P.P.10 forms

- Original tax invoices

- Purchased goods (unused)

Step 3: Validate Your Goods at the Airport

Before checking in your luggage:

- Go to the VAT Refund Inspection Counter (Customs)

- Show your items, receipts, and P.P.10 forms

- Customs will stamp your forms for approval

Step 4: Submit Refund Forms After Immigration

After passport control, find the VAT Refund Office in the departure hall.

You can choose your refund method:

Refund Methods

Method | Notes |

|---|---|

Cash | Instant but includes higher fees |

Credit card refund | Lower fees; refunded in 30–45 days |

Bank transfer | Available but extra fees apply |

e-Wallet (Alipay/WeChat) | Available at some airports |

Downtown VAT Refund (Before departure)

- Refund transaction ≤ 12,000 baht

- Cash: Downtown VAT Refund agents

- Remark: The goods have to be taken out within 14 days from the date of downtown vat refund claim

Airport VAT refunds

- Refund transaction ≤ 30,000 baht

- Cash: VAT refund officers

- Credit/Debit card: VAT refund officers , Form submission by main or VRT application

- WeChat/Alipay: VRT application

Fly to Thailand

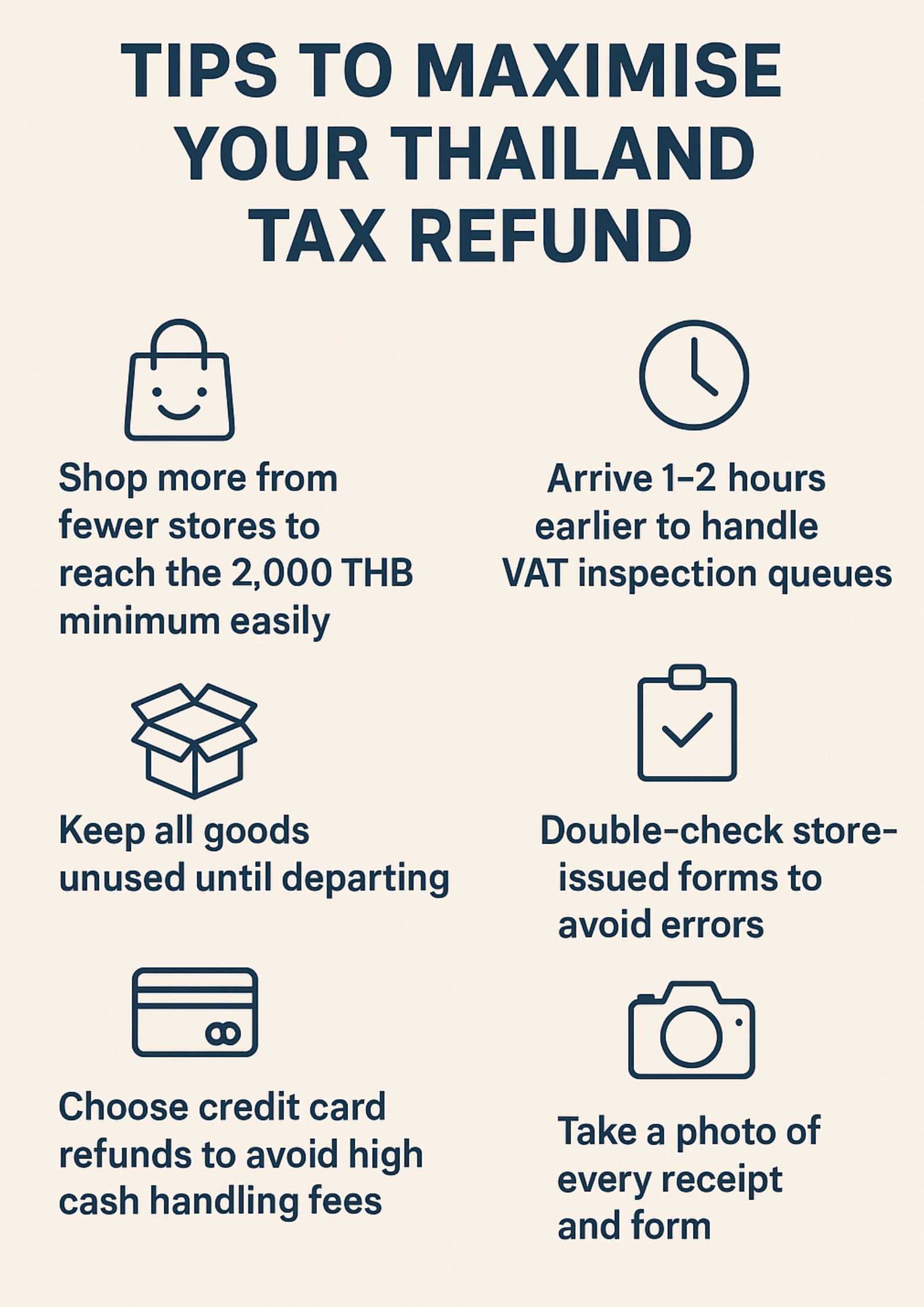

💡 Tips to Maximize Your Thailand Tax Refund

Best Hotels in Thailand

⚠️ Common Mistakes to Avoid

Happy Shopping in Thailand!

Claiming a Thailand tax refund for tourists is one of the easiest ways to stretch your travel budget, especially if you plan to shop for fashion, electronics, beauty products, or souvenirs.

By purchasing from participating stores, meeting the minimum spending requirements, and keeping your items unused until airport inspection, you can enjoy meaningful savings before flying home.

Beyond shopping, Thailand offers a wide range of accommodation options to make your trip more comfortable.

Whether you stay in luxury hotels in Bangkok, chic boutique stays in Chiang Mai, beachfront resorts in Phuket, or budget-friendly hostels near public transport, choosing the right hotel can elevate your travel experience.

Staying near major shopping areas such as Siam, Asoke, Sukhumvit, Pratunam, and ICONSIAM, also makes it easier to reach VAT-participating stores and manage your purchases.

With smart planning, organized receipts, and the right choice of hotel location, your Thailand trip becomes smoother, more enjoyable, and more rewarding both in comfort and in tax savings.

FAQ: Tax Refund Thailand

Can I open or use items before the flight?

No. Items must remain unused for inspection.Can I claim VAT refund at land borders?

No. Refunds are only available at international airports.Are all stores in Thailand tax-free?

No. Only stores with the VAT Refund for Tourists sign participate.What is the Thailand tax refund rate?

The VAT rate is 7%, but tourists receive around 4%–5% back after processing fees.What is Thailand Tax Refund for Tourists?

A program allowing foreign visitors to claim back VAT paid on eligible goods purchased in Thailand.Can I refund VAT at land borders?

No. Refunds are only available at international airports.

NO.1

NO.1