Shopping in Italy is one of the highlights for many traveller including luxury brands, leather goods, fashion houses, and artisan products.

The good news? Non-EU visitors can reclaim part of the VAT charged on purchases.

This guide explains the Italy tax refund rate, how to use an Italy tax refund calculator, and exactly how much tax refund in Italy you can expect as a tourist.

🧾 What Is the Italy Tax Refund for Tourists?

Italy charges a Value Added Tax (VAT) on most goods. The standard VAT rate is 22%, and tourists who reside permanently outside the EU can claim back a portion of this tax when they shop in Italy.

You must export the purchased goods outside the EU within 3 months from the end of the buying month.

📌 Italy Tax Refund Requirements

To qualify, you must:

Requirement | Description |

|---|---|

Live outside the EU | Only non-EU residents are eligible for VAT refunds in Italy. |

Minimum spend: €154.95 per store per day | Purchases must meet or exceed €154.95 in a single store on the same day to qualify. |

Export goods within 3 months | Items must leave the EU no later than 3 months after the end of the purchase month. |

Keep receipts & tax-free forms | Original store receipts and VAT refund forms are required for validation. |

Validate at EU Customs before departure | All documents must be stamped or electronically validated by Customs at your final EU exit point. |

📊 Italy Tax Refund Rate

The standard Italy tax refund rate is based on the VAT rate applied to your purchase.

- Standard VAT in Italy: 22%

- Refund amount after fees: 11%–15% of the purchase value

Why is the refund lower than 22%?

Tax-free companies (Global Blue, Planet, etc.) deduct processing service fees, so travellers receive a reduced but still meaningful amount.

💶 How Much Is Tax Refund in Italy?

Purchase Value | VAT (22%) | Approx Refund |

|---|---|---|

€200 | €36.07 | €20–€26 |

€500 | €90.16 | €55–€70 |

€1,000 | €180.33 | €120–€145 |

🧮 Using an Italy Tax Refund Calculator

An Italy tax refund calculator helps estimate your refund after fees.

Most calculators consider:

- Purchase price

- VAT rate (22%)

- Service fee deductions

- Refund method (cash refunds have higher fees)

General formula

As a quick rule:

- Expect 10%–14% refund of your spending amount.

Fly to Italy

✅ Comparison: Major Tax-Refund Providers in Italy

| Provider | Where you’ll find them in Italy | Refund methods | Service / Fees & timing (typical) | Notes |

|---|---|---|---|---|

Global Blue | Widely available in major stores and at big airports (offices & kiosks). | Cash (airport), card/bank transfer, in-store credit options. | Service fee deducted from VAT; refunds by card typically processed in a few days–weeks. Kiosk & counter options available. |

|

Planet (formerly Premier / Tax Free Worldwide) | Common in Italian retailers and airports (has staffed desks and self-service kiosks). | Cash, card/bank transfer, app tracking. | Charges a handling fee; refunds processed to card within up to 30 days (varies by method). Self-service kiosks speed up turnaround. |

|

TaxRefund.it (local operator) | Offices and counters at many Italian airports (notably Fiumicino, Malpensa) and partnered stores. | Cash at airport desks; post/mail refunds also offered. | Option for immediate cash refunds at airport offices (subject to verification). Processing/fees vary; follow provider instructions for mailing stamped forms. |

|

📝 How to Claim Italy Tax Refund

Step 1: Shop at stores offering “Tax-Free Shopping”

Look for signs from:

- Global Blue

- Planet

- Tax Refund Italy

Step 2: Show your passport at purchase

- Stores require your physical passport to issue tax-free paperwork.

Step 3: Keep all receipts, forms, and invoices

- Ensure your shopping details, passport number, and purchase values are correct.

Step 4: Validate your documents at Customs before leaving the EU

- At the airport or EU border, go to the Agenzia delle Dogane (Customs) counter and present:

Required Item | Description |

|---|---|

Your receipts | Original purchase receipts from each store. |

Tax-free forms | Completed VAT refund forms issued by the store (e.g., Global Blue, Planet). |

Passport | Physical passport required for identity and eligibility verification. |

Boarding pass | Proof of departure from the EU on the same trip. |

The actual goods (unused) | Items must be presented to Customs and remain unused before leaving the EU. |

- Customs will stamp or digitally validate your forms.

- Without validation → No refund.

Step 5: Get your refund

- Drop it in the Global Blue/Planet mailbox, or

- Visit the refund counter for cash or credit card refunds.

Refund methods

Method | Notes |

|---|---|

Cash | Fastest, but highest fees. |

Credit Card | Lower fees; refund appears in 1–3 months. |

Bank account | Available but slower and with fees. |

Hotels in Italy

✈️Step-by-Step VAT-Refund Process at Italy’s Top Airports

Rome Fiumicino Airport (FCO)

Before departure : check-in luggage vs carry-on matters

- If purchased goods are going in checked luggage, you must get your VAT refund validated (“customs stamp”) before check-in.

- If goods are in hand luggage, validation can usually be done after security.

Find Customs (Dogana) for stamp

- Customs desks are located in Terminal 3 (common), before check-in if necessary, or near the airside boarding area for carry-on.

- Submit goods + documents: passport, boarding pass, original receipts + Tax-Free forms, and goods (unused, in original condition). Customs may ask to see items.

After stamp → refund desk

- Go to the refund provider’s counter (Global Blue or Planet) or self-service kiosk, depending on your form.

- Choose your refund method: cash (immediate, after fee deduction) or credit-card/bank transfer (sent later).

Timing & Buffer

- Because of possible queues and customs checks, allow at least 60–90 minutes extra when departing.

- If for any reason you cannot complete at the airport, you may mail the stamped forms but refund will be delayed.

Milan Malpensa Airport (MXP)

Prepare before arrival:

- Keep purchases unused; ensure items you want stamped are not packed away in checked luggage before stamp.

Go to Customs (Dogana) before check-in if goods are in checked baggage

- There are dedicated VAT-refund/customs counters in Terminal 1.

If goods are carry-on, you can also validate after security,

- But check signage and ensure you go before any final EU exit (if you have connecting flights, the last EU airport must do stamp).

After Customs stamp → refund processing

- Use the airport’s “Global Blue / Planet / self-service kiosks / desks” : Global Blue kiosks are common in Terminal 1 of MXP.

- Refund options: cash, card/bank, depending on what’s specified on your form.

Allow extra time, especially in peak hours:

- Because MXP is large and can be congested, give yourself enough buffer time so you don’t risk missing your flight.

Venice – Marco Polo (VCE)

Before you fly

- Request and verify the Tax-Free invoice when paying (passport name, date, shop stamp). Keep items unused.

At the airport

- Locate Customs on arrival at the departures area and present goods + Tax-Free forms for stamping. Venice’s airport guidance confirms the need to present forms, passport and boarding pass for validation.

- After Customs stamp, submit the stamped form to the refund provider counter or kiosk (Global Blue / Planet are commonly available at Marco Polo). Choose cash (if available) or card refund and keep receipt/tracking info.

🛒 Where to Shop Tax-Free in Italy

In Rome

📍 Via del Corso

Via del Corso is Rome’s most lively and accessible shopping street, stretching from Piazza Venezia to Piazza del Popolo.

Lined with international brands, affordable fashion, cosmetics stores, and souvenir shops, it’s ideal for tourists looking for mid-range shopping.

The street is wide, energetic, and pedestrian-friendly, making it perfect for a casual shopping day combined with sightseeing.

📍 Via dei Condotti (Luxury Brands)

Via dei Condotti is Rome’s premier luxury shopping street, home to iconic Italian brands such as Gucci, Fendi, Valentino, Bulgari, and Prada.

Located just steps from the Spanish Steps, this elegant street offers a sophisticated shopping experience with high-end boutiques and flagship stores.

It’s the go-to area for premium luxury goods and tax-free purchases.

📍 Castel Romano Designer Outlet

Located about 25 minutes from central Rome, Castel Romano Designer Outlet offers more than 150 stores featuring discounted luxury and designer brands.

Expect outlets for Michael Kors, Burberry, Valentino, Versace, Adidas, and more—with savings of 30–70% year-round.

The outlet also provides tax-free services, shuttle transfers, and wide dining options, making it a full-day shopping destination.

In Milan

📍 Galleria Vittorio Emanuele II

Often called "Il Salotto di Milano" (Milan’s living room), this historic glass-domed arcade is one of the world’s oldest shopping malls.

It houses luxury boutiques, high-end cafés, and iconic Italian brands.

Visitors come not just to shop, but also to admire its spectacular architecture, mosaic floors, and landmark beauty.

📍 Via Montenapoleone (Quadrilatero della Moda)

Via Montenapoleone is the heart of Milan’s legendary fashion district, the Quadrilatero della Moda.

It features the most exclusive boutiques such as Hermès, Louis Vuitton, Tod’s, Dior, Chanel, and top Italian designers.

Known for its luxury craftsmanship and premium boutiques, this street is one of the most prestigious shopping destinations in the world.

📍 Serravalle Designer Outlet (Europe’s Largest Outlet)

Serravalle Designer Outlet is the largest outlet mall in Europe, featuring more than 230 stores offering discounts up to 70% off throughout the year.

Located about an hour from Milan, it includes luxury brands like Prada, Versace, Moncler, Saint Laurent, and more.

It offers shuttle buses, multilingual staff, VIP lounges, and plenty of dining options, making it perfect for international shoppers seeking big savings.

In Florence

📍 San Lorenzo Leather Market

A bustling open-air market famous for genuine Italian leather goods such as bags, jackets, belts, wallets, and handcrafted accessories.

Located near the historic San Lorenzo Basilica, the market is a paradise for shoppers wanting high-quality leather at competitive prices.

Many stalls offer customizable products and handmade craftsmanship unique to Tuscany.

📍 The Mall Firenze (Luxury Outlet)

One of Italy’s most famous luxury outlets, The Mall Firenze offers premium brands like Gucci, Prada, Burberry, Balenciaga, Saint Laurent, and Valentino at discounted prices.

Set amidst the scenic Tuscan hills, the outlet provides a stylish shopping experience with VIP services, tax-free desks, cafes, and year-round designer discounts.

In Venice

📍Calle Larga XXII Marzo

A classy shopping street near St. Mark’s Square, lined with luxury fashion boutiques such as Chanel, Celine, Max Mara, and Gucci.

The street combines Venice’s romantic charm with upscale retail, making it a must-visit for travelers seeking premium brands in a picturesque setting.

📍 Fondaco dei Tedeschi (DFS)

Fondaco dei Tedeschi is a stunning luxury department store inside a historic Venetian palace.

Operated by DFS, it offers high-end fashion, beauty, accessories, jewelry, and Italian gourmet products.

The rooftop terrace provides one of the best panoramic views of Venice. With tax-free services and curated brands, it’s a top shopping spot for international visitors.

🔥Exclusive Hotels Deal: Up to 10% OFF for New Users

Discover the world with trip.com! Book the perfect hotel anywhere in the world and get an unbeatable 10% discount if you're a first-time user! Download our app now and start planning your next trip with ease.

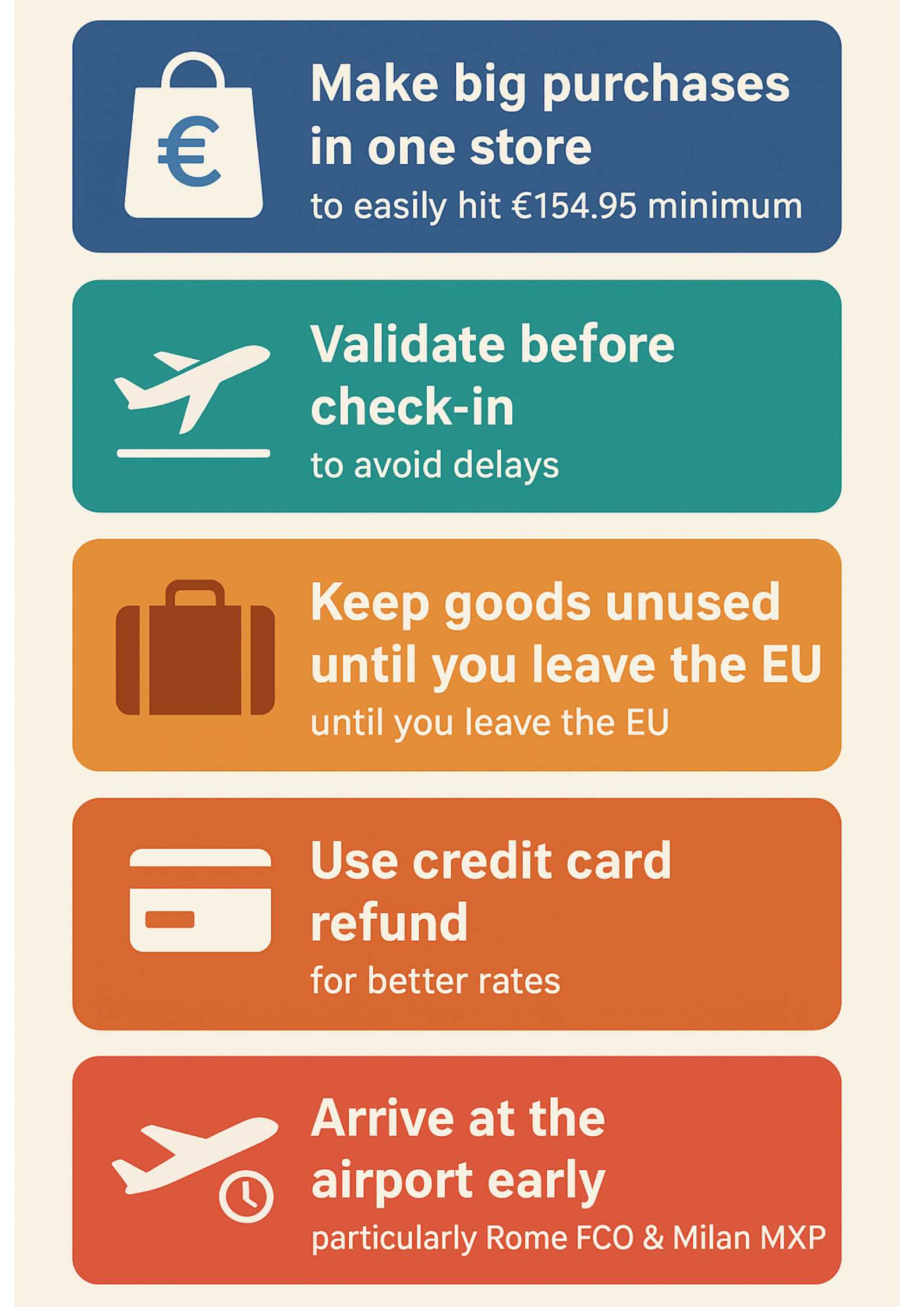

💡 Tips to Maximise Your Italy VAT Refund

❗ Common Mistakes to Avoid

✨ Conclusion

Italy offers one of the most rewarding VAT refund systems in Europe. By understanding the Italy tax refund rate, using an Italy tax refund calculator, and following the correct steps, tourists can save significantly especially when buying luxury Italian brands.

If you’re planning a shopping trip, remember: organisation is key, and refunds can add up quickly!

FAQ: Tax Refund Italy

Who is eligible for a tax refund in Italy?

Only non-EU residents who purchase goods in Italy and export them outside the EU within 3 months are eligible.What is the Italy tax refund rate?

Italy’s standard VAT rate is 22%, but the actual refund you receive is typically 10–14% after service fees from operators like Global Blue or Planet.What is the minimum spend for tax-free shopping in Italy?

You must spend €154.95 or more in a single store on the same day.Where do I validate my tax-free forms?

At the EU Customs office located at your final exit point from the EU, such as Rome FCO or Milan MXP.Can I pack tax-free goods in checked luggage?

Avoid this. Customs may ask to inspect the items. Keep them in carry-on until validation is complete.How long do I have to leave the EU after purchase?

You must export goods within 3 months at the end of the purchase month (e.g., buy in March → must depart by June 30).Can I get a refund on food, drinks, or services?

No. Refunds apply only to physical goods (fashion, leather, electronics, jewelry, cosmetics, etc.).How long to get VAT refund Italy

- Cash Refund at the Airport — Immediately

- Credit Card Refund — Usually 2 to 8 Weeks

- Bank Transfer Refund — Around 4 to 10 Weeks

- If You Mail Your Stamped Form — 2 to 3 Months (or Longer)

NO.1

NO.1