Travelling in Switzerland can be an unforgettable experience, but it’s no secret that things here are on the pricier side.

The good news? Tourists can get a Switzerland tax refund for tourist purchases, putting a bit of cash back in your pocket.

Let’s break down how it works, the rates, and how you can calculate your refund before you shop.

What is a Switzerland Tax Refund?

A Switzerland tax refund allows non-residents to reclaim the VAT (Value Added Tax) paid on goods purchased in the country.

The standard Swiss VAT rate is 7.7%, but some goods like food or books may have reduced rates.

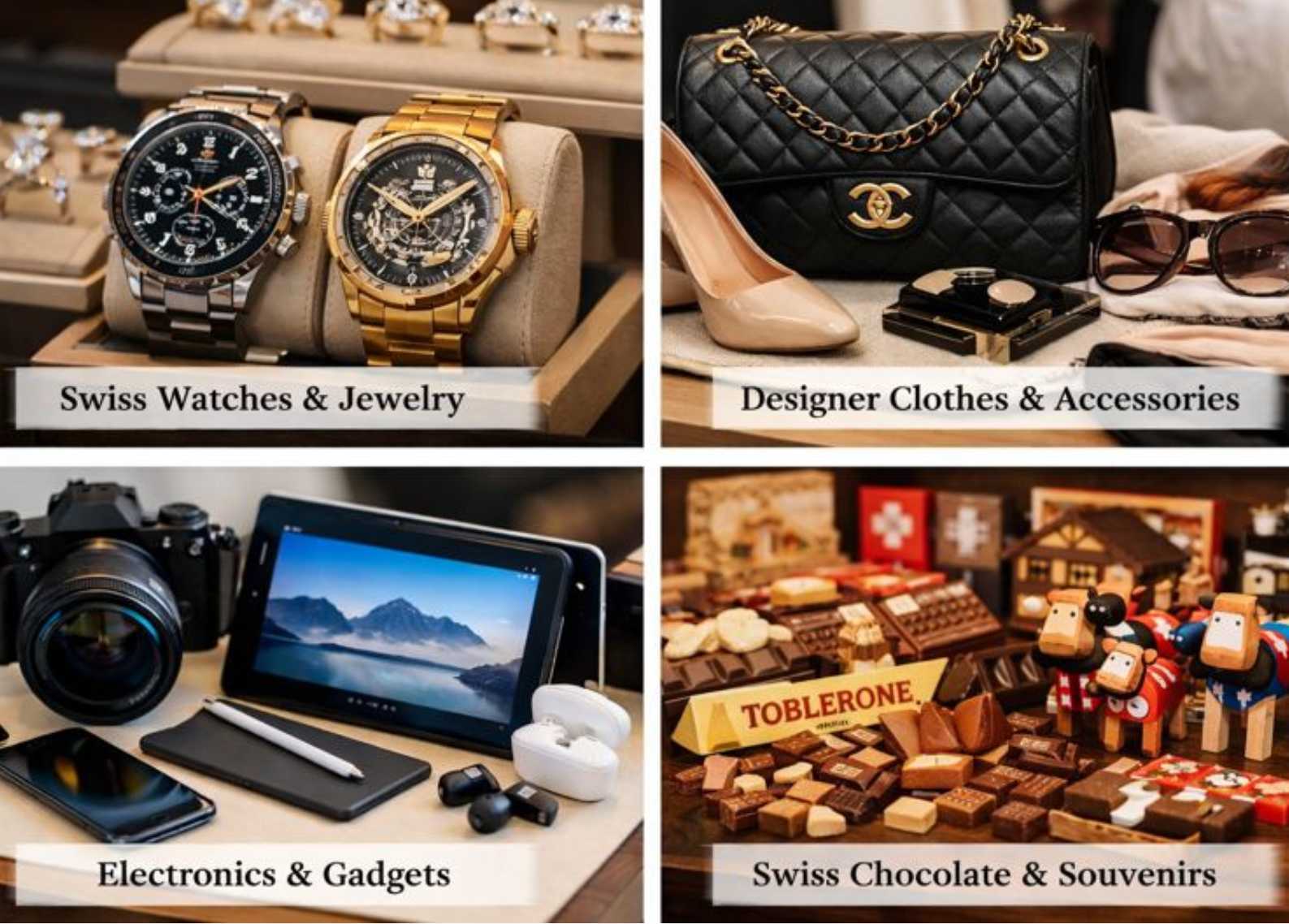

Basically, when you buy souvenirs, chocolate, watches, or other goods, you don’t have to bear the full cost if you follow the tax refund process.

Who Can Claim a Switzerland Tax Refund?

Eligibility Requirement | Details |

|---|---|

Tourist or non-Swiss resident | You must live outside Switzerland and be visiting as a tourist |

Minimum purchase amount | Purchases must exceed CHF 300 per store per day |

Export timeframe | Goods must be unused and exported from Switzerland within 30 days |

Switzerland Tax Refund Rate

Most items will give you a refund of around 5–7% of the purchase price, slightly less than the official VAT due to administrative fees from companies like Global Blue or Premier Tax Free.

For example, if you spend CHF 1,000 on a watch, your Switzerland tax refund rate might give you roughly CHF 50–70 back.

How to Claim Your Switzerland Tax Refund

Step 1: Shop at tax-free stores

Look for stores with “Tax-Free Shopping” signs and request a tax refund form.

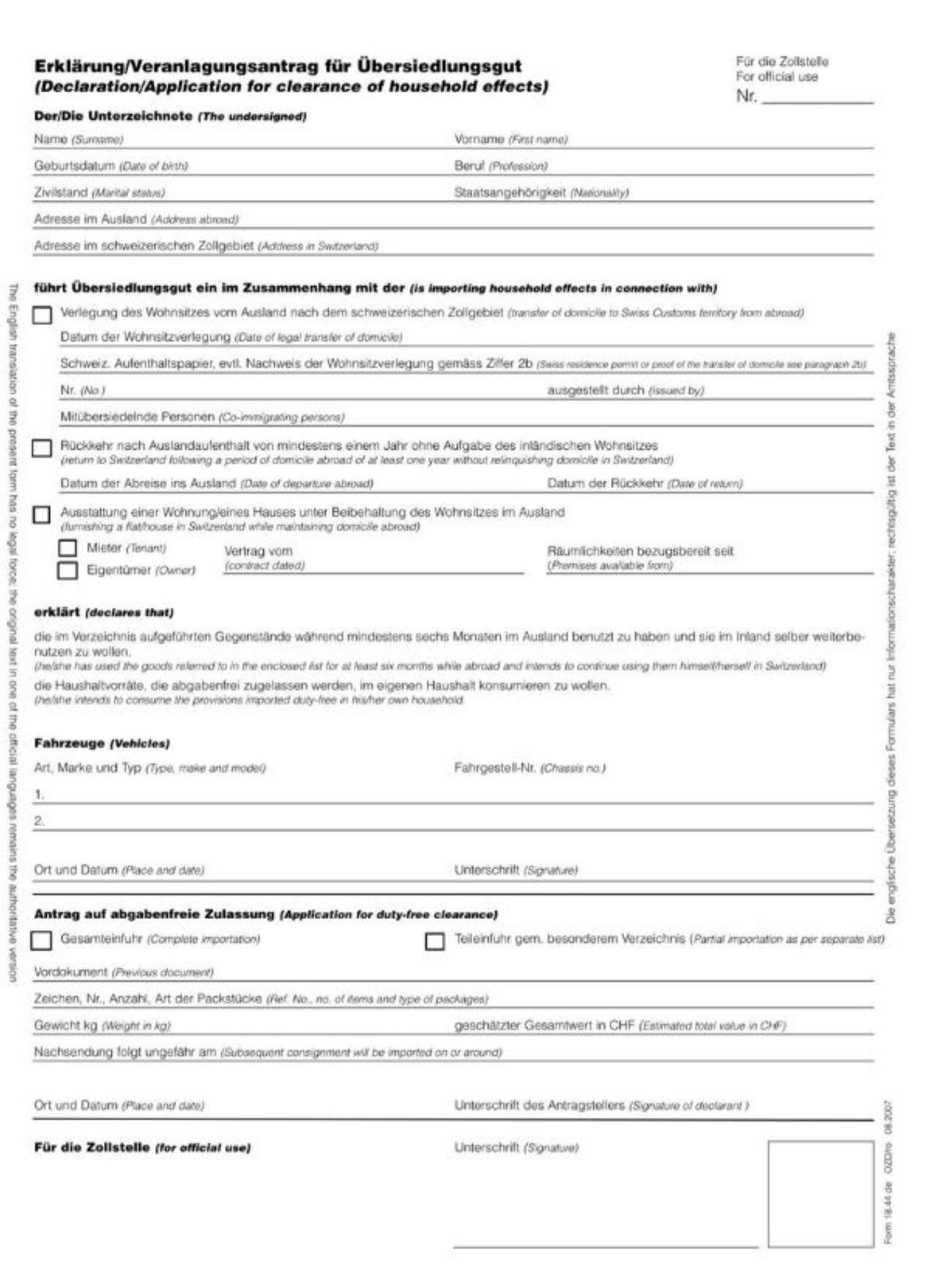

Step 2: Fill out your forms

Provide passport details, receipts, and purchase info. Keep everything together.

Step 3: Get customs approval

Before leaving Switzerland, show your purchases and forms at the airport or border to get a stamp.

Step 4: Receive your refund

- On the spot at the airport (cash or credit card)

- By mail after sending the stamped form to the refund agency

Cheap Flight to Zurich

Switzerland Tax Refund Calculator

A Switzerland tax refund calculator can help you estimate how much you’ll get back before shopping. Simply enter:

Calculation Factor | Description |

|---|---|

Total purchase amount | The full amount you spent on eligible goods (in CHF) |

VAT rate | Usually 7.7%, depending on the product category |

Refund agency fees | Processing fees deducted by tax refund providers (e.g. Global Blue, Premier Tax Free) |

Popular Tax-Free Shopping Items in Switzerland

Best Hotels in Zurich

Tips for a Smooth Tax Refund Experience

- Keep all receipts and forms together

- Arrive at the airport early for customs processing

- Don’t open or use purchased goods before leaving Switzerland

- Check if the store charges a handling fee

Final Thoughts

A Switzerland tax refund for tourist purchases is an easy way to save a little on your trip.

Knowing the Switzerland tax refund rate, using a Switzerland tax refund calculator, and following the steps carefully can make the process smooth.

Before you go, ask yourself: “How much is tax refund in Switzerland?” With a little planning, you can reclaim some VAT and enjoy your Swiss shopping without regrets.

FAQ: Switzerland Tax Refund

What is a Switzerland tax refund?

A Switzerland tax refund allows tourists and non-Swiss residents to reclaim the VAT (Value Added Tax) paid on eligible goods purchased in Switzerland when they export the items out of the country.How much is tax refund in Switzerland?

The standard Switzerland tax refund rate is based on a VAT of 7.7%. After processing fees, tourists typically receive around 5–7% of the purchase value as a refund.Can I open or use items before leaving Switzerland?

No. Goods must remain unused and may need to be shown to customs. Used or opened items may result in refund rejection.Is tax refund available for food and chocolate?

Yes, Swiss chocolate and souvenirs are generally eligible, but food items may be subject to reduced VAT rates, meaning the refund amount could be lower.

NO.1

NO.1