Many travelers visiting the United States are surprised to learn that there is no nationwide VAT refund system like in Europe or Asia.

Instead of VAT, the USA uses state-level sales tax, and most states do not offer any tax refund in USA for tourist.

However, a few exceptions allow international visitors to get some money back.

This guide explains how to do tax refund in USA, what states offer refunds, who qualifies, and how to claim tax refund in USA for tourist step-by-step.

What Is a Tax Refund in the USA?

The USA does not charge VAT (Value Added Tax). Instead, it uses state sales tax, an additional tax which is added at checkout and usually non-refundable.

Since sales tax is controlled by individual states, there is no federal tourist refund scheme, and visitors generally cannot reclaim sales tax.

However, there are exceptions in certain states, and some retailers allow tax-free shopping through approved operators.

States That Offer Tax Refund in USA for Tourist

Although most states don’t offer refunds, Louisiana and Texas have systems that allow international tourists to reclaim sales tax on certain purchases.

Louisiana Tax Free Shopping (Official State Program)

Louisiana is the only state in the USA with an official, government-backed tourist refund program.

However, the official Louisiana Tax Free Shopping Program for International Visitors (LTFS) has officially ended as of July 1, 2024, by the provisions of Act 255 of the 2023 Louisiana Legislature.

Texas (Refund Through Private Operators)

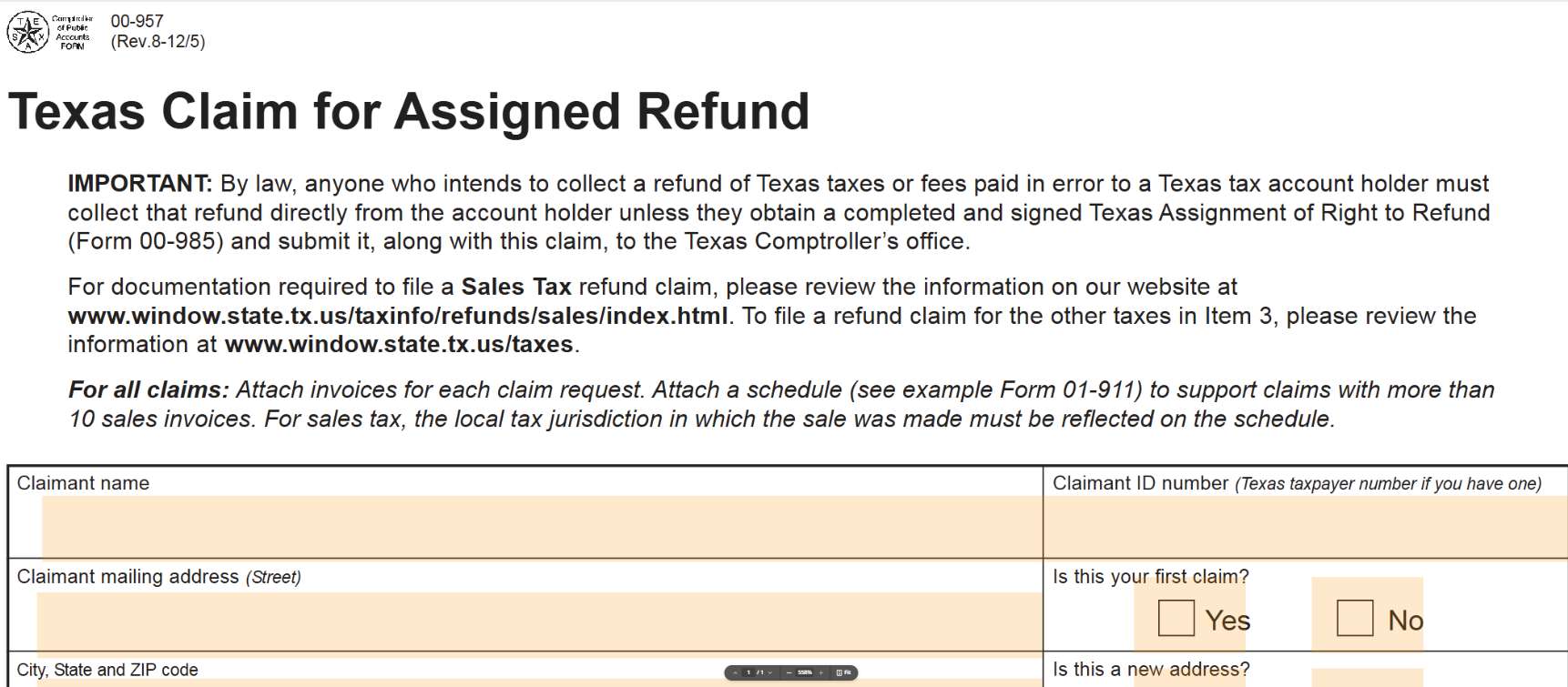

Texas does not offer a government program, but private tax refund companies which called Assignment of Right to Refund that authorized to help tourists reclaim sales tax.

Where it’s available

- Dallas–Fort Worth International Airport (DFW)

- Houston George Bush Intercontinental Airport (IAH)

- Houston Hobby Airport (HOU)

Requirements

| Requirement | Details |

|---|---|

Items must be purchased at participating retailers | Only purchases from approved tax-free or refund-partner stores qualify. |

Goods must be taken out of the U.S. | Items must leave the country with you and be available for inspection at the airport. |

Passport is required | A valid foreign passport must be shown to confirm you are an international visitor. |

How "Refund Through Private Operators" Works

If a purchaser has paid sales tax in error to a seller who holds a Texas sales and use tax permit, the purchaser must first request the refund directly from the seller.

| Step | Description |

|---|---|

Seller Grants the Refund | The seller can refund the sales tax directly to the customer. |

Assignment of Right to Refund | If the seller cannot or will not refund the tax, they may issue Form 00-985 (Assignment of Right to Refund) to the purchaser. |

Purchaser Files with the State | Using Form 00-985, the purchaser (assignee) can submit a refund claim directly to the Texas Comptroller of Public Accounts. |

This mechanism effectively allows the "private operator" (the seller) to authorize their customer (the purchaser) to pursue the refund from the state on their own behalf.

A separate form must be completed for each vendor from which a refund is claimed.

Other Specific Refund Programs

Texas also has specific, dedicated refund programs for certain types of businesses and purchases that operate similarly:

| Category | Refund Eligibility |

|---|---|

Telecommunications / Internet Providers | Providers of cable TV, internet access, or telecommunications services can claim a refund of state sales and use tax on qualifying tangible personal property used directly in providing those services. Refund claims are submitted annually to the Texas Comptroller. |

Qualified Data Centers | Purchasers with a valid data center registration number may obtain a refund from the retailer or use an Assignment of Right to Refund to claim tax back directly from the state. |

Remote Sellers | If a purchaser pays more local tax than required to a remote seller using the single local use tax rate, they can apply directly to the state for a refund of the difference. |

❌ States That Do NOT Offer Tourist Tax Refunds

Most popular tourist states do not provide any tax refund in USA for tourist. However, in these states, sales tax is final and non-refundable.:

- California (Los Angeles, San Francisco)

- New York (NYC)

- Florida (Miami, Orlando)

- Hawaii

- Nevada (Las Vegas)

- Illinois (Chicago)

Best Hotels in USA

How Much Can You Get Back?

Refund amounts vary by state and retailer:

| State | Approximate Refund Rate | Notes |

|---|---|---|

Louisiana | Up to 10.45% | Varies by local/parish tax rates; applies only to purchases from participating Tax Free stores. |

Texas | 6%–8.25% | Depends on county and participating retailers; refunds usually processed through private operators. |

What Items Qualify for a Refund?

| Category | Items |

|---|---|

Eligible for Tax Refund | Clothing, Fashion & luxury goods, Jewelry, Cosmetics, Electronics, Souvenirs |

Not Eligible for Tax Refund | Hotels, dining, tours, Car rentals & vehicles, Online orders delivered to U.S. addresses, Services of any kind |

Required Documents for a USA Sales Tax Refund

To claim a refund, you’ll need:

| Required Document | Description |

|---|---|

Passport | Valid foreign passport to confirm international visitor status. |

International boarding pass | Proof of departure from the United States. |

Original receipts from participating stores | Printed receipts only; digital receipts are usually not accepted. |

Purchased goods (unused) | Items must be in original condition and available for inspection. |

Completed refund form | Provided by refund operators or airport refund counters. |

Conclusion

In short, the U.S. does not offer a federal VAT-style tax refund for tourists, making it very different from many international destinations.

However, for savvy travelers, there are opportunities to reclaim sales tax but only state like Texas, and through specific programs or private refund operators.

To claim a refund, you’ll need to buy from participating retailers, keep your original receipts, bring your unused goods to the airport, and present your passport and refund forms.

For those planning to shop in the U.S., knowing how to do tax refund in the USA and how to claim tax refund in USA for tourist can save you money.

Just remember: not every state offers refunds, and you’ll need to do a bit of prep. If you shop smart and follow the steps, you can make the most of the limited U.S. tax refund system available to international visitors.

Cheap Flight to New York

FAQ: USA Tax Refund

How to do tax refund in USA if I shop in California or New York?

You cannot claim a refund in these states. Sales tax is non-refundable.How to claim tax refund in USA for tourist at the airport?

Visit the tax refund counter (available in Texas airports), show your receipts, passport, and goods, then submit your claim.Can I refund hotel or restaurant tax?

No. Taxes on services are never refundable.Is the refund available for U.S. residents traveling abroad?

No. Refunds apply only to international visitors holding foreign passports.Do I need to show the items I bought?

Yes, in most cases the items must be unused and available for inspection at the airport.

NO.1

NO.1